Notification / OM No.

No. F.1(6)/Imp/2005

Dated:

13-October-2006

Notification Issued By:

(REGULATIONS WING) FINANCE DIVISION, GOVERNMENT OF PAKISTAN

GOVERNMENT OF PAKISTAN

FINANCE DIVISION

(Regulations Wing)

No. F.1(6)/Imp/2005

Islamabad, the 13th October, 2006

OFFICE MEMORANDUM

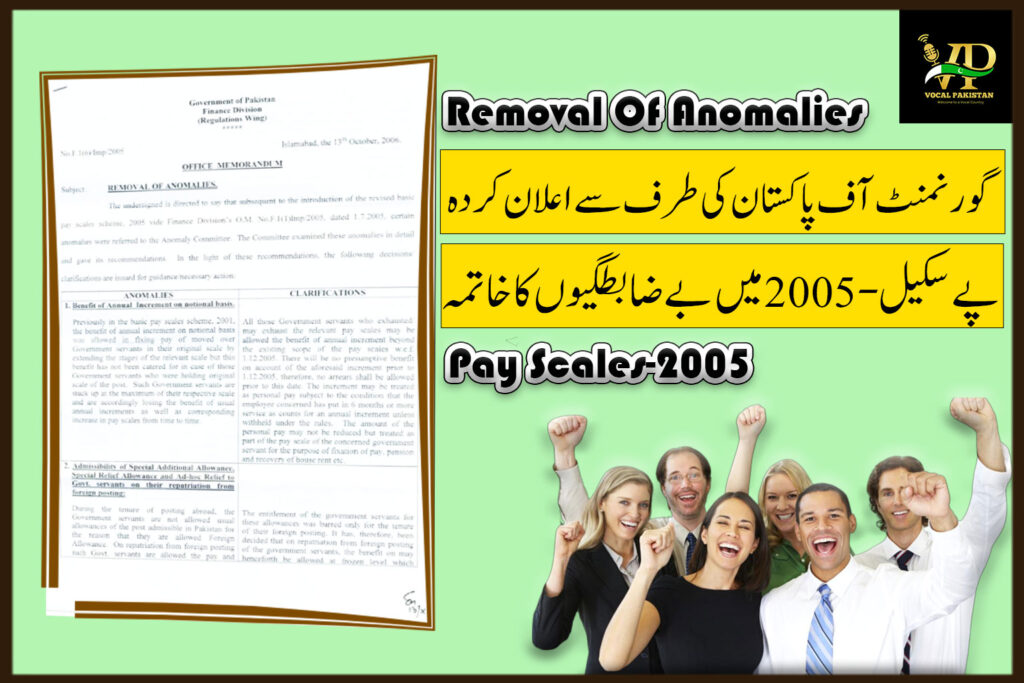

Subject: REMOVAL OF ANOMALIES

The undersigned is directed to say that subsequent to the introduction of the revised basic pay scales scheme. 2005 vide Finance Division’s O.M. No.F.1(1)Imp/2005, dated 1.7.2005, certain anomalies were referred to the Anomaly Committee, The Committee examined the anomalies in detail and gave recommendations. In the light or these recommendations, the following decisions, clarifications are issued for guidance necessary action.

| ANOMALIES | CLARIFICATIONS |

| Benefit of Annual increment on notional basis. Previously in the basic pay scales scheme, 2001, the benefit of annual increment on notional basis was allowed in fixing pay of moved over Government servants in their original scale by extending the stages of the relevant scale but this benefit has not been catered for in case of those Government servants who were holding original scale of the post. Such Government servants are stuck up at the maximum of their respective scale and are accordingly losing the benefit of usual annual increments as well as corresponding increase in pay scales from time to time. | All those Government servants who exhausted/ may exhaust the relevant pay scales may be allowed the benefit of annual increment beyond the existing scope of the pay scales w.e,f, 1.12.2005. There will be no presumptive benefit on account of the aforesaid increment prior to 1.12.2005, therefore, no arrears shall be allowed prior to this date. The increment may be treated as personal pay subject to the condition that the employee concerned has put in 6 months or more service as counts for an annual increment unless withheld under the rules. The amount of the personal pay may not be reduced but treated as part of the pay scale of the concerned government servant for the purpose of fixation of pay, pension and recovery of house rent etc. |

| Admissibility of Special Additional Allowance Special Relief Allowance and Ad-hoc Relief to Govt. Servants on their repatriation from foreign posting: During the tenure of posting abroad, the Government servants are not allowed usual allowances of the post admissible in Pakistan for the reason that they are allowed Foreign Allowance. On repatriation from foreign posting such Govt. servants are allowed the pay and allowances of the posts which would have been admissible to them had they not been pasted abroad. Despite this admissibility the benefit of the ad-hoc increase i.e. Special Additional Allowance, Special Relief Allowance and Ad-hoc Relief at frozen level has not been extended to the said category of Govt. servants for the reason that prior to their posting abroad they were not the recipients of these allowances and before their repatriation, these allowances were discontinued under the revised basics pay scales scheme, 2001 and 2005 respectively. This has caused a disparity to the extent that the said category of Government servants are at disadvantageous position in terms of the salary/emoluments as compared to their counterparts. | The entitlement of the government servants for these allowances was barred only for the tenure of their foreign posting. It has, therefore, been decided that on repatriation from foreign posting of the government servants. the benefit on may henceforth be allowed at frozen level which henceforth be allowed at frozen level which would have been admissible to them had they not been posted abroad. |

| 3. Deputation Special Pay: On posting to Ministries/Divisions/ Departments, the officers of Pakistan Audit and Accounts Services were allowed Deputation Special Pay @ 20% of the minimum of the pay scale whereas on deputation to Foreign Service in Pakistan, Deputation Allowance @ 20% of minimum of the pay scale was admissible to all deputationists. In 1994 the position was reviewed and the Deputation Special Pay was converted into Deputation Allowance with a saving provision that those Govt. servants who were already getting Deputation Special Pay would continue to draw the same as “Deputation Pay” rill their reversion from their deputation or retirement from service while on deputation. Subsequently, the converted Deputation Allowance has been revised from time to time and this allowance is presently admissible @ 20% of basic pay subject to maximum Rs.6000/- p.m. But “Deputation Special Pay” (defunct) has not been revised. Resultantly the beneficiaries of Deputation Special Pay are continuing to draw the same at the rate and amount as admissible prior to its conversion in 1994. This amount is very nominal as compared to deputation allowance, which caused a disparity. | Consequent upon conversion into allowance, the erstwhile deputation special pay had become defunct which cannot be treated parallel to deputation allowance. Therefore, it cannot be revived/revised, However, the entitled beneficiaries of the defunct Deputation Special Pay can avail the benefit of Deputation Allowance subject to their option to be exercised in writing latest by 31st December, 2006. |

Section Officer (Imp)