Notification / OM No.

No.F.7 (3) R-10/2023

Dated:

06-August-2023

Notification Issued By:

Regulations Wing, Finance Division, Government of Pakistan

GOVERNMENT OF PAKISTAN

FINANCE DIVISION

(Regulations Wing)

No.F.7 (3) R-10/2023

Islamabad, the 6th August, 2023

OFFICE MEMORANDUM

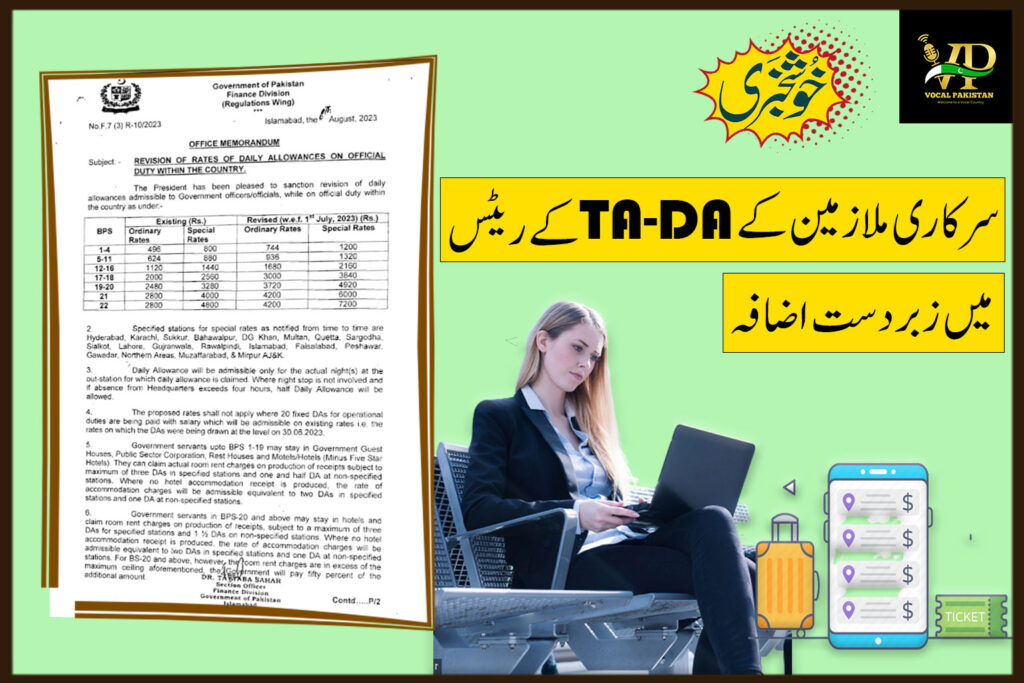

Subject: REVISION OF RATES OF DAILY ALLOWANCES ON OFFICIAL DUTY WITHIN THE COUNTRY

The President has been pleased to sanction revision of daily allowances admissible to Government officers/officials, while on official duty within the country as under:-

| BPS | Existing (Rs.) | Revised (w.e.f. 1st July, 2023) (Rs.) | ||

| Ordinary Rates | Special Rates | Ordinary Rates | Special Rates | |

| 1-4 | 496 | 800 | 744 | 1200 |

| 5-11 | 624 | 880 | 936 | 1320 |

| 12-16 | 1120 | 1440 | 1680 | 2160 |

| 17-18 | 2000 | 2560 | 3000 | 3840 |

| 19-20 | 2480 | 3280 | 3720 | 4920 |

| 21 | 2800 | 4000 | 4200 | 6000 |

| 22 | 2800 | 4800 | 4200 | 7200 |

2. Specified stations for special rates as notified from time to time are Hyderabad, Karachi, Sukkur, Bahawalpur, DG Khan, Multan, Quetta, Sargodha, Sialkot, Lahore, Gujranwala, Rawalpindi, Islamabad, Faisalabad, Peshawar, Gawadar, Northern Areas, Muzaffarabad, & Mirpur AJ&K.

3. Daily Allowance will be admissible only for the actual night(s) at the out-station for which daily allowance is claimed. Where night stop is not involved and if absence from Headquarters exceeds four hours, half Daily Allowance will be allowed.

4. The proposed rates shall not apply where 20 fixed DAs for operational duties are being paid with salary which will be admissible on existing rates i.e. the rates on which the DAs were being drawn at the level on 30.06.2023.

5. Government servants upto BPS 1-19 may stay in Government Guest Houses, Public Sector Corporation, Rest Houses and Motels/Hotels (Minus Five Star Hotels). They can claim actual room rent charges on production of receipts subject to maximum of three DAs in specified stations and one and half DA at non-specified stations. Where no hotel accommodation receipt is produced, the rate of accommodation charges will be admissible e equivalent to two DAs in specified stations and one DA at non-specified stations.

6. Government servants in BPS-20 and above may stay in hotels and claim room rent charges on production of receipts, subject to a maximum of three DAs for specified stations and 1½ DAs on non-specified stations. Where no hotel accommodation receipt is produced, the rate of accommodation charges will be admissible equivalent to two DAs in specified stations and one DA at non-specified stations. For BS-20 and above, however the room rent charges are in excess of the maximum ceiling aforementioned, the government will pay fifty percent of the additional amount.

7. The earlier instructions issued by the Finance Division shall stand superseded and replaced by this Office Memorandum to the above extent.

Section Officer (R-10)