Notification / OM No.

No.F.1 (5) Imp/2011-419

Dated:

4-July-2011

Notification Issued By:

FINANCE DIVISION (Regulation Wing) GOVERNMENT OF PAKISTAN

GOVERNMENT OF PAKISTAN

FINANCE DIVISION

(Regulation Wing)

No.F.1 (5) Imp/2011-419

Islamabad, the 4th July, 2011

OFFICE MEMORANDUM

Subject: REVISION OF BASIC PAY SCALES, ALLOWANCES AND PENSION OF CIVIL SERVANTS OF THE FEDERAL GOVERNMENT.

The President has been pleased to sanction the revision of Basic Pay Scales, Allowances and Pension with effect from 1st July, 2011 for the Civil Servants of the Federal Government, paid out of Civil Estimates and out of Defence Estimates as detailed in the succeeding paragraphs:-

PART-I (PAY)

2. Revision of Basic Pay Scales:

The Basic Pay Scales-2011 shall replace the Basic Pay Scales-2008 with effect from 01.07.2011 as contained in the Annexure to this Office Memorandum.

3. Fixation of Pay of the Existing Employees (w. e. f. 01.07.2011):

i. The basic pay of an employee who was in service on 30.06.2011 shall be fixed in the Basic Pay Scale-2011 on point to point basis i.e. at the stage corresponding to that occupied by him/her above the minimum of Basic Pay Scales-2008.

ii. In case of Personal Pay being drawn by an employee as part of his/her basic pay beyond the maximum of his/her pay scale on 30.06.2011, he/she shall continue to draw such pay in the Basic Pay Scales-2011 at the revised rates.

4. Annual Increment:

Annual increment shall continue to be admissible, subject to the existing conditions, on 1st of December each year.

PART-II (ALLOWANCES)

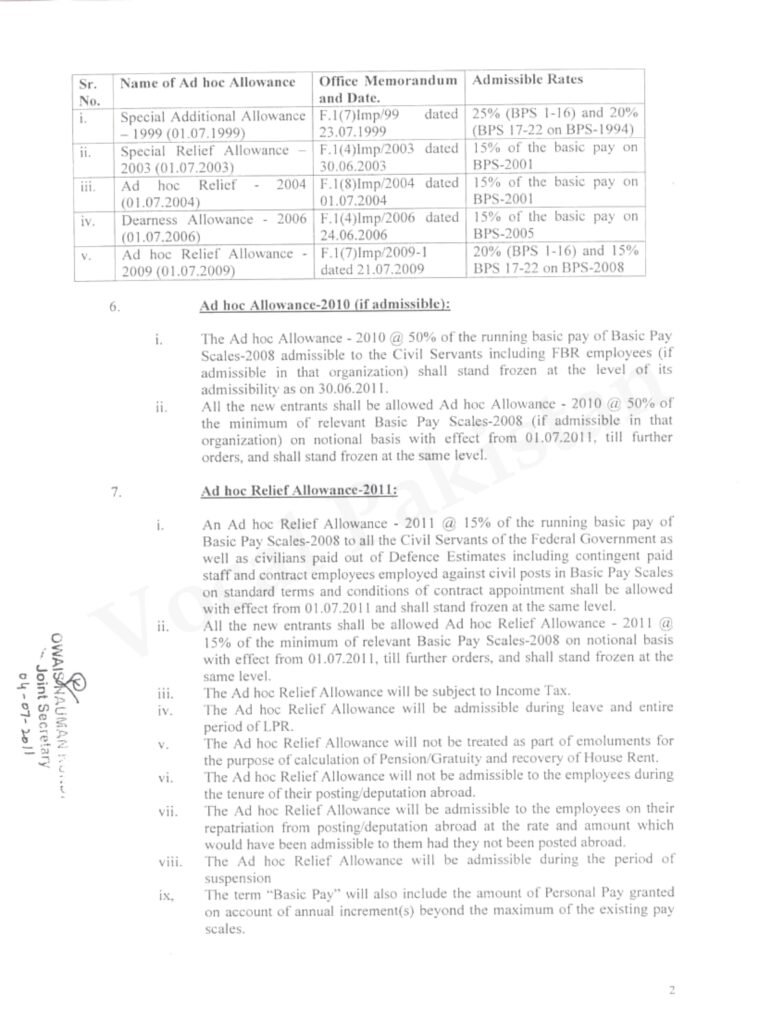

5. Ad hoc Relief Allowances granted upto 01.07.2009:

The following Ad hoc Relief Allowances granted upto 01.07.2009 shall stand discontinued with effect from 01.07.2011 having been merged in the Basic Pay Scales-2008 so as to introduce Basic Pay Scales-2011:-

| 2 Sr. No. | Name of Ad hoc Allowance _ | Office Memorandum and Date. | Admissible Rates |

| i. | Special Additional Allowance – 1999 (01.07.1999) | F.1(7)Imp/99 dated 23.07.1999 | 25% (BPS 1-16) and 20% (BPS 17-22 on BPS-1994) |

| ii. | Special Relief Allowance – 2003 (01.07.2003) | F.1(4)Imp/2003 dated 30.06.2003 | 15% of the basic pay on BPS-2001 |

| iii.. | Ad hoc Relief – 2004 (01.07.2004) | F.1(8)Imp/2004 dated 01.07.2004 | 15% of the basic pay on BPS-2001 |

| iv, | Dearness Allowance – 2006 (01.07.2006) | F. I (4)Irnp/2006 dated 24.06.2006 | 15% of the basic pay on BPS-2005 |

| v. | Ad hoe Relief Allowance – 2009 (01.07.2009) | F.1(7)1mp/2009-1 dated 21.07.2009 | 20% (BPS 1-16) d 15% BPS 17-22 on BPS-2008 |

| 20% (BPS 1-16) and 15% BPS 17-22 on BPS-2008 |

6. Ad hoc Allowance – 2010 (if admissible):

i. The Ad hoc Allowance – 2010 @ 50% of the running basic pay of Basic Pay Scales-2008 admissible to the Civil Servants including FBR employees (if admissible in that organization) shall stand frozen at the level of its admissibility as on 30.06.2011.

ii. All the new entrants shall be allowed Ad hoc Allowance – 2010 @ 50% of the minimum of relevant Basic Pay Scales-2008 (if admissible in that organization) on notional basis with effect from 01.07.2011, till further orders, and shall stand frozen at the same level.

7. Ad hoc Relief Allowance-2011:

i. An Ad hoc Relief Allowance – 2011 @ 15% of the running basic pay of Basic Pay Scales-2008 to all the Civil Servants of the Federal Government as well as civilians paid out of Defence Estimates including contingent paid staff and contract employees employed against civil posts in Basic Pay Scales on standard terms and conditions of contract appointment shall be allowed with effect from 01.07.2011 and shall stand frozen at the same level.

ii. All the new entrants shall be allowed Ad hoc Relief Allowance – 2011 @ 15% of the minimum of relevant Basic Pay Scales-2008 on notional basis with effect from 01.07.201l, till further orders, and shall stand frozen at the same level.

iii. The Ad hoc Relief Allowance will be subject to Income Tax.

iv. The Ad hoc Relief Allowance will be admissible during leave and entire period of LPR.

v. The Ad hoc Relief Allowance will not be treated as part of emoluments for the purpose of calculation of Pension/ Gratuity and recovery of House Rent.

vi. The Ad hoc Relief Allowance will not be admissible to the employees during the tenure of their posting/deputation abroad.

vii. The Ad hoc Relief Allowance will be admissible to the employees on their repatriation from posting/deputation abroad at the rate and amount which would have been admissible to them had they not been posted abroad.

viii. The Ad hoc Relief Allowance will be admissible during the period of suspension.

ix. The term “Basic Pay” will also include the amount of Personal Pay granted on account of annual increment(s) beyond the maximum of the existing pay scales.

8. Medical Allowance:

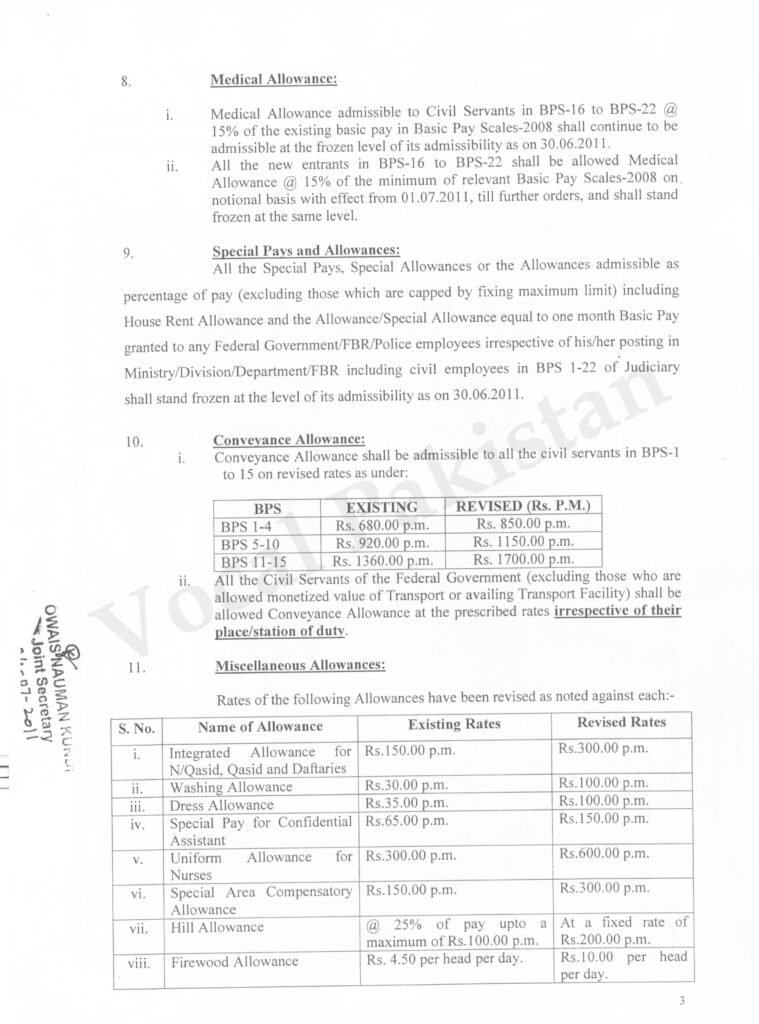

- Medical Allowance admissible to Civil Servants in BPS-16 to BPS-22 @ 15% of the existing basic pay in Basic Pay Scales-2008 shall continue to be admissible at the frozen level of its admissibility as on 30.06.2011.

- All the new entrants in BPS-16 to BPS-22 shall be allowed Medical Allowance @ 15% of the minimum of relevant Basic Pay Scales-2008 on notional basis with effect from 01.07.2011, till further orders, and shall stand frozen at the same level.

9. Special Pays and Allowances:

All the Special Pays, Special Allowances or the Allowances admissible as percentage of pay (excluding those which are capped by fixing maximum limit) including House Rent Allowance and the Allowance/Special Allowance equal to one month Basic Pay granted to any Federal Government/FBR/Police employees irrespective of his/her posting in Ministry/Division/Department/FBR including civil employees in BPS 1-22 of Judiciary shall stand frozen at the level of its admissibility as on 30.06.2011.

10. Conveyance Allowance:

- Conveyance Allowance shall be admissible to all the civil servants in BPS-1 to 15 on revised rates as under:

| BPS | Existing | Revised (Rs. P.M) |

| BPS 1-4 | Rs. 680.00 p.m | Rs. 850.00 p.m |

| BPS 5-10 | Rs. 920.00 p.m | Rs. 1150.00 p.m |

| BPS 11-15 | Rs. 1360.00 p.m | Rs. 1700.00 p.m |

- All the Civil Servants of the Federal Government (excluding those who are allowed monetized value of Transport or availing Transport Facility) shall be allowed Conveyance Allowance at the prescribed rates irrespective of their place/station of duty.

11. Miscellaneous Allowances:

Rates of the following Allowances have been revised as noted against each:-

| S. No. | Name of Allowance | Existing Rates | Revised Rates |

| i. | Integrated Allowance for N/Qasid, Qasid and Daftaries | Rs.150.00 p.m. | Rs.300.00 p.m. |

| ii. | Washing Allowance | Rs.30.00 p.m. | Rs.100.00 p.m. |

| iii. | Dress Allowance | Rs.35.00 p.m. | Rs.100.00 p.m. |

| iv. | Special Pay for Confidential Assistant | Rs.65.00 p.m. | Rs. 150.00 p.m. |

| v. | Uniform Allowance for Nurses | Rs.300.00 p.m. | Rs.600.00 p.m. |

| vi. | Special Area Compensatory Allowance | Rs.150.00 p.m. | Rs.300.00 p.m. |

| vii. | Hill Allowance | @ 25% of pay upto a maximum of Rs.100.00 p.m. | At a fixed rate of Rs.200.00 p.m. |

| viii. | Firewood Allowance | Rs. 4.50 per head per day. | Rs.10.00 per head per day. |

12. Revision of Pension:

All the existing Civil Pensioners of the Federal Government including Civilians paid out of Defence Estimates have been allowed an increase in their pension at the following rates with effect from 1st July, 2011, until further orders:-

- Pensioners who retired on or after 01.07.2002 @ 15% of the net pension.

- Pensioners who retired on or before 30.06.2002 @ 20% of net pension.

13. On introduction of the Basic Pay Scales-2011, the increases in pension allowed vide para-3 of the Finance Division Office Memorandum No. F.4 (1) Reg-6/2010/721 dated 05.07.2010 shall be discontinued to the new pensioners who would retire on or after 01.07.2011 who opts to draw pension under the Scheme of Basic Pay Scales-2011.

14. However, 15% increases in pension allowed vide para-2 of the Finance Division Office Memorandum No.F.4 (1) Reg-6/2010/721 dated 05.07.2010 shall continue to be admissible to the new pensioners who would retire on or after 01.07.2011 who opts to draw pension under the Scheme of Basic Pay Scales-2011.

15. The 15% increase in pension as mentioned at Paras-12 (i) above shall also be admissible to the pensioners who would retire on or after 01.07.2011.

16. For the purpose of admissibility of increase in pension for the Civil Pensioners sanctioned in this Office Memorandum the term “Net Pension” means “Pension being drawn” minus “Medical Allowance”, which shall be continued to be admissible at the level of its admissibility as on 30.06.2011.

17. The increase shall also be admissible on family pension granted under the Pension-cum-Gratuity Scheme, 1954, Liberalized Pension Rules, 1977, on pension sanctioned under the Central Civil Services (Extra Ordinary Pension) Rules as well as on the Compassionate Allowance under CSR-353.

18. If the gross pension sanctioned by the Federal Government is shared with any Government in accordance with the rules laid down in part-IV of Appendix III to the Accounts Code, Volume-I, the amount of the increase in pension shall be apportioned between the Federal Government and the other Government concerned on proportionate basis.

19. The increase in pension sanctioned in this Office Memorandum shall not be admissible on Special Additional Pension allowed in lieu of pre-retirement Orderly Allowance.

20. The increase in pension shall not be admissible during the period of their reemployment, but the same shall be allowed after the termination of the re-employment contract. However, the increase in pension admissible .to the pensioners of the Federal Government before their re-employment on contract basis shall continue to be admissible to them provided that they are not in receipt of any increases allowed as allowances with their pay in lieu of increases in pension.

21. The benefit of increase in pension sanctioned in this Office Memorandum shall also be admissible to those Civil Pensioners of the Federal Government who are residing abroad (other than those residing in India and Bangladesh) who retired on or after 15.08.1947 and are not entitled to, or are not in receipt of pension increase under the British Government’s Pension (increase) Acts. The payment shall be made at the applicable rate of exchange.

22. Medical Allowance for the Pensioners:

i. Medical Allowance admissible to the existing retired Civil Servants in BPS-1 to BPS-15 and in BPS-16 to BPS-22 @ 25% and @ 20% of the net pension respectively shall continue to be admissible at the frozen level of its admissibility as on 30.06.2011 and till further orders.

ii. All the Civil Servants in BPS-1 to BPS-15 and in BPS-16 to BPS-22, who shall retire on or after 01.07.2011 onwards, shall be allowed Medical Allowance @ 25% and @20% of the net pension respectively and shall stand frozen at the same level.

23. Option:

- The Ministry/Division/Department/Office to which an employee belongs and/or on whose pay roll he/she is borne shall obtain an option in writing from such employees within 60 days commencing from the date of issue of this Office Memorandum and communicate it to the concerned Accounts Office/DDO, as the case may be, either to continue to draw salary in the Scheme of Basic Pay Scales-2008 or in the Scheme of Basic Pay Scales-2011 as specified in this Office Memorandum. Option once exercised shall be considered final.

- An existing employee, as aforesaid, who does not exercise and communicate his/her option within the specified time limit, shall be deemed to have opted for the Scheme of Basic Pay Scales-2011.

24. All the existing rules/orders on the subject shall be considered to have been modified to the extant indicated above. All the existing rules/orders not so modified shall continue to be in force under this scheme.

25. Anomalies:

An Anomaly Committee shall be set up in the Finance Division (Regulations Wing) to resolve the anomalies, if any, arising in the implementation of the Basic Pay Scales-2011 and pension.

Joint Secretary (Regs)

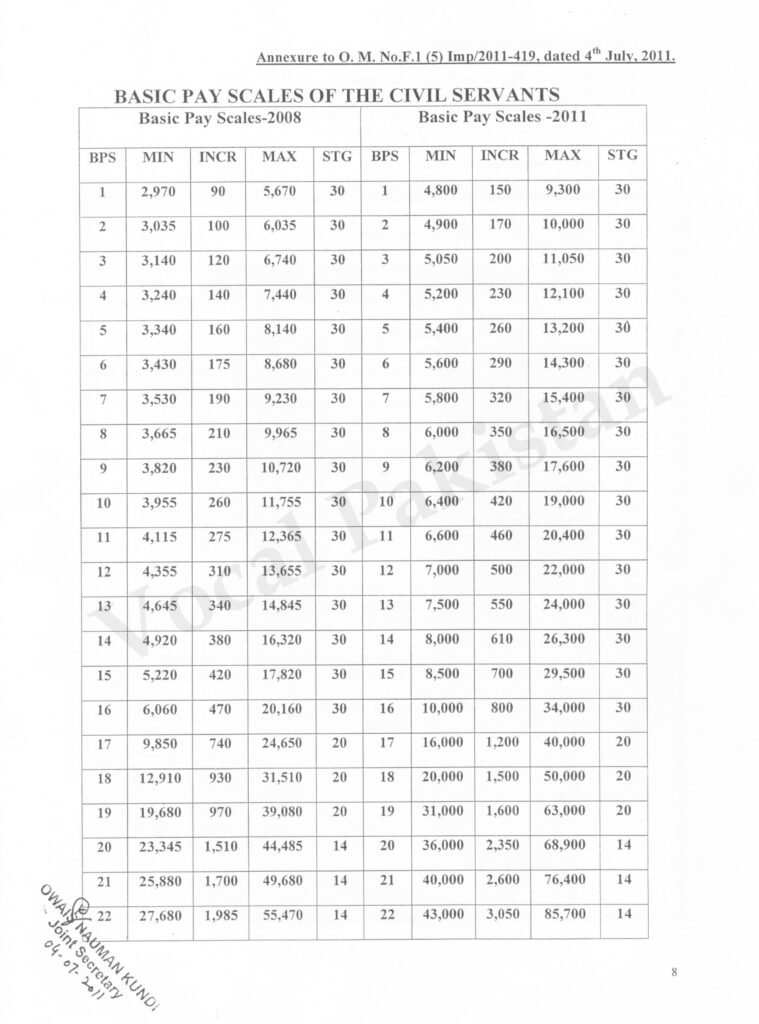

Annexure to O.M. No. F.1(5)Imp/2011-419, dated 4th July, 2011

BASIC PAY SCALES OF THE CIVIL SERVANTS

| Basic Pay Scales-2008 | Basic Pay Scales-2011 | ||||||||

| BPS | MIN | INCR | MAX | STG | BPS | MIN | INCR | MAX | STG |

| 1 | 2970 | 90 | 5670 | 30 | 1 | 4800 | 150 | 9300 | 30 |

| 2 | 3035 | 100 | 6035 | 30 | 2 | 4900 | 170 | 10000 | 30 |

| 3 | 3140 | 120 | 6740 | 30 | 3 | 5050 | 200 | 11050 | 30 |

| 4 | 3240 | 140 | 7440 | 30 | 4 | 5200 | 230 | 12100 | 30 |

| 5 | 3340 | 160 | 8140 | 30 | 5 | 5400 | 260 | 13200 | 30 |

| 6 | 3430 | 175 | 8680 | 30 | 6 | 5600 | 290 | 14300 | 30 |

| 7 | 3530 | 190 | 9230 | 30 | 7 | 5800 | 320 | 15400 | 30 |

| 8 | 3665 | 210 | 9965 | 30 | 8 | 6000 | 350 | 16500 | 30 |

| 9 | 3820 | 230 | 10720 | 30 | 9 | 6200 | 380 | 17600 | 30 |

| 10 | 3955 | 260 | 11755 | 30 | 10 | 6400 | 420 | 19000 | 30 |

| 11 | 4115 | 275 | 12365 | 30 | 11 | 6600 | 460 | 20400 | 30 |

| 12 | 4355 | 310 | 13655 | 30 | 12 | 7000 | 500 | 22000 | 30 |

| 13 | 4645 | 340 | 14845 | 30 | 13 | 7500 | 550 | 24000 | 30 |

| 14 | 4920 | 380 | 16320 | 30 | 14 | 8000 | 610 | 26300 | 30 |

| 15 | 5220 | 420 | 17820 | 30 | 15 | 8500 | 700 | 29500 | 30 |

| 16 | 6060 | 470 | 20160 | 30 | 16 | 10000 | 800 | 34000 | 30 |

| 17 | 9850 | 740 | 24650 | 20 | 17 | 16000 | 1200 | 40000 | 20 |

| 18 | 12910 | 930 | 31510 | 20 | 18 | 20000 | 1500 | 50000 | 20 |

| 19 | 19680 | 970 | 39080 | 20 | 19 | 31000 | 1600 | 63000 | 20 |

| 20 | 23345 | 1510 | 44485 | 14 | 20 | 36000 | 2350 | 68900 | 14 |

| 21 | 25880 | 1700 | 49680 | 14 | 21 | 40000 | 2600 | 76400 | 14 |

| 22 | 27680 | 1985 | 55470 | 14 | 22 | 43000 | 3050 | 85700 | 14 |

At Vocal Pakistan, we are dedicated to keeping our valued employees informed about updates that directly impact their well-being. For further details and clarifications regarding this or any other notification, please do not hesitate to reach out to our WhatsApp Group.