Rep. No.975/FTO/2024

14-February-2025

President’s Secretariat (Public)

President of Pakistan Dismisses FBR’s Appeal, Ensures Tax Rebate for Principals & Teachers:

In a landmark decision impacting thousands of educators, the President of Pakistan has ruled in favor of government school principals and teachers, rejecting the Federal Board of Revenue’s (FBR) representation against the Federal Tax Ombudsman (FTO)’s decision. This ruling ensures that Principals, Vice-Principals, and Headmasters of government schools receive the same tax rebate as full-time teachers, aligning their tax benefits with those in Federal Government Institutions and Khyber Pakhtunkhwa (KPK).

The case, initiated by Ahmed Bakash, Principal of Government Higher Secondary School, Dina, highlighted the unfair withdrawal of income tax rebate for school heads. The FTO had previously ruled that denying tax benefits to school principals while granting them to their counterparts in FG institutions and KPK schools was discriminatory and amounted to maladministration. The FBR appealed against this ruling, but the President of Pakistan upheld the FTO’s decision, stating that under the Finance Act 2022, both categories (Principals and Teachers) are now treated equally. Please find the official notification below:

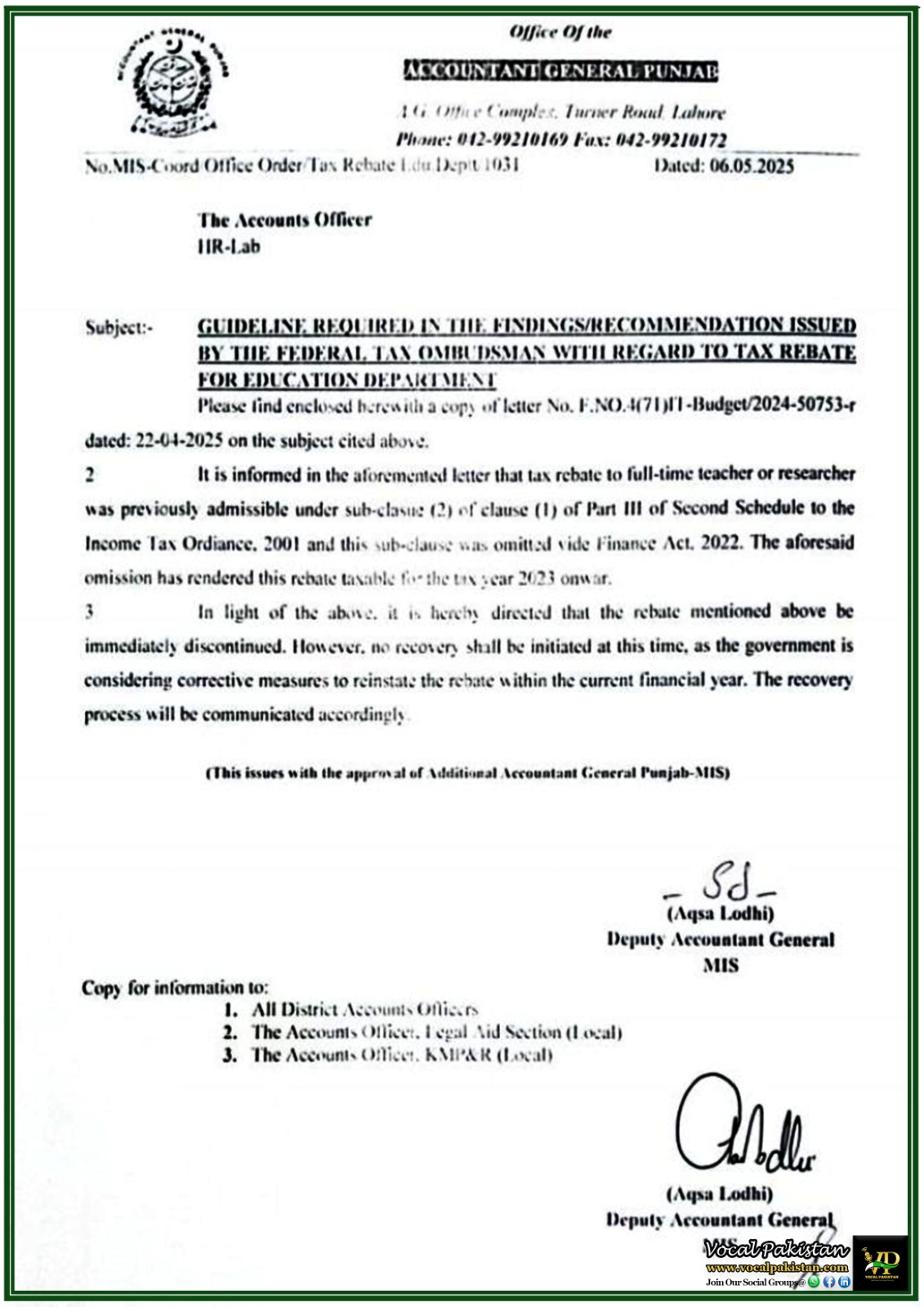

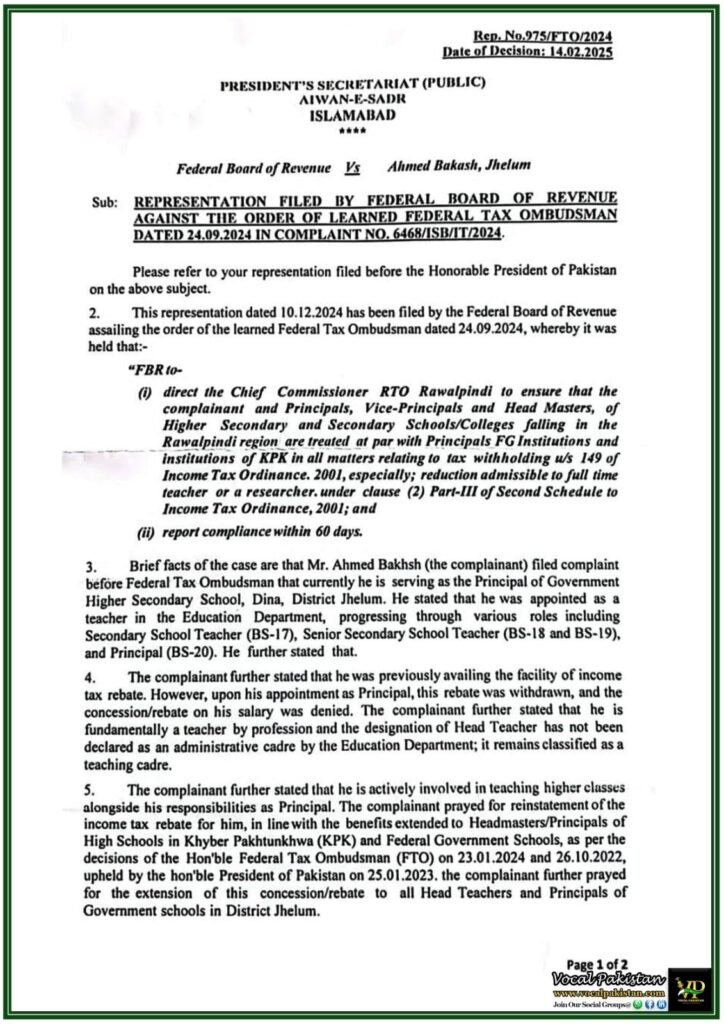

Rep. No.975/FTO/2024

Date of Decision: 14.02.2025

PRESIDENT’S SECRETARIAT (PUBLIC)

AIWAN-E-SADR

ISLAMABAD

Federal Board of Revenue Vs Ahmed Bakash, Jhelum

SUBJECT: REPRESENTATION FILED BY FEDERAL BOARD OF REVENUE AGAINST THE ORDER OF LEARNED FEDERAL TAX OMBUDSMAN DATED 24.09.2024 IN COMPLAINT NO. 6468/ISB/IT/2024.

Please refer to your representation filed before the Honorable President of Pakistan on the above subject.

2. This representation dated 10.12.2024 has been filed by the Federal Board of Revenue assailing the order of the learned Federal Tax Ombudsman dated 24.09.2024, whereby it was held that:-

“FBR to-

(i) direct the Chief Commissioner RTO Rawalpindi to ensure that the complainant and Principals, Vice-Principals and Head Masters, of Higher Secondary and Secondary Schools/Colleges falling in the Rawalpindi region are treated at par with Principals FG Institutions and institutions of KPK in all matters relating to tax withholding u/s 149 of Income Tax Ordinance. 2001, especially; reduction admissible to full time teacher or a researcher. under clause (2) Part-III of Second Schedule to Income Tax Ordinance, 2001; and

(ii) report compliance within 60 days.

3. Brief facts of the case are that Mr. Ahmed Bakhsh (the complainant) filed complaint before Federal Tax Ombudsman that currently he is serving as the Principal of Government Higher Secondary School, Dina, District Jhelum. He stated that he was appointed as a teacher in the Education Department, progressing through various roles including Secondary School Teacher (BS-17), Senior Secondary School Teacher (BS-18 and BS-19), and Principal (BS-20). He further stated that.

4. The complainant further stated that he was previously availing the facility of income tax rebate. However, upon his appointment as Principal, this rebate was withdrawn, and the concession/rebate on his salary was denied. The complainant further stated that he is fundamentally a teacher by profession and the designation of Head Teacher has not been declared as an administrative cadre by the Education Department; it remains classified as a teaching cadre.

5. The complainant further stated that he is actively involved in teaching higher classes alongside his responsibilities as Principal. The complainant prayed for reinstatement of the income tax rebate for him, in line with the benefits extended to Headmasters/Principals of High Schools in Khyber Pakhtunkhwa (KPK) and Federal Government Schools, as per the decisions of the Hon’ble Federal Tax Ombudsman (FTO) on 23.01.2024 and 26.10.2022, upheld by the hon’ble President of Pakistan on 25.01.2023. the complainant further prayed for the extension of this concession/rebate to all Head Teachers and Principals of Government schools in District Jhelum.

6. The Federal Board of Revenue responded before the FTO that the rebate in salary is only admissible to full time teachers or researchers as defined in clause (2), Part-III of Second Schedule of the Income Tax Ordinance, 2001 read with Circular No. 06 of 2013 dated 19.07.2013 and the same rebate is not allowed to Principals/Headmasters.

7. The Federal Tax Ombudsman has observed that the selective application of benefit of reduction of tax liability to Principals, Vice-Principals, Head Master and fulltime teachers of FG Colleges and Schools and Colleges of KPK and denying the same to the other colleges/schools and Principals etc similarly placed including the complainant is found contrary to law, arbitrary which constitute maladministration in terms of section 2(3)(ii) of the FTO, Ordinance, 2000.

8. Considering the respective stances, the learned FTO proceeded to pass the impugned order. Hence the representation filed by the FBR.

9. The case was fixed for hearing on 16.01.2025. Mr. Mazhar Iqbal and Mr. Ali Muhammad, Commissioners appeared on behalf of the petitioner/ FBR. The respondent, Mr. Ahmed Bakash appeared in person. The learned Commissioners stated that under the Finance Act 2022, both the categories are now treated at par. Faced with this, it was suggested to them that now they have been treated at par then obviously the representation has become infructuous because earlier also the President of Pakistan in a number of cases had ordered that both the categories should be treated at par. The representation has thus become infructuous because of the Finance Act 2022 which has treated both the categories at par. Orders accordingly.

10. Accordingly, the Honorable President has accorded approval to para-9 above.

Consultant (Legal Affairs)

Landmark Decision: Equal Tax Benefits for All Educators in Pakistan:

This decision marks a significant victory for educational professionals across Pakistan, ensuring that Principals, Vice-Principals, and Headmasters receive the same tax rebate as full-time teachers. The ruling eliminates previous discrepancies in tax policies, providing financial relief to senior educators who continue to fulfill teaching responsibilities alongside administrative duties.

The move also sets a precedent for fair taxation policies in Pakistan’s education sector, bringing all government educational institutions under a uniform tax structure. Teachers and school heads across the country are encouraged to review their tax deductions and ensure compliance with the new ruling.

For more information, clarification or any other question feel free to join our WhatsApp Group. We are a supportive community where members are committed to assisting one another.