No. F. 9(3)/Reg.6/2024-264

03-January-2025

Regulations Wing, Finance Division, Government of Pakistan

Key Reforms in Pension Policies by Finance Division: What You Need to Know:

The Finance Division of the Government of Pakistan has always been committed to maintaining clarity and transparency in financial regulations and policies, particularly those concerning pensions and retirement benefits. This notification addresses significant updates and clarifications regarding Special Family Pension and Voluntary Retirement Penalties. In light of Finance Division’s earlier Office Memorandum (O.M.) dated 10th September 2024, various government departments and organizations raised pertinent queries. To ensure consistent understanding and implementation of these policies, the Finance Division has provided detailed responses to these queries, outlined in the attached Annex-I and Annex-II.

This notification aims to define key terms, eligibility criteria, and conditions regarding the Special Family Pension for eligible dependents of Armed Forces/Civil Armed Forces personnel. It also elaborates on the recently introduced penalties for voluntary retirement, including the annual flat reduction in pension for early retirees. These clarifications ensure equitable treatment for all stakeholders while maintaining the integrity of the financial management system. By addressing concerns from stakeholders across federal and provincial levels, this document underscores the Finance Division’s commitment to fostering a well-regulated and fair pension system. Notification Describes;

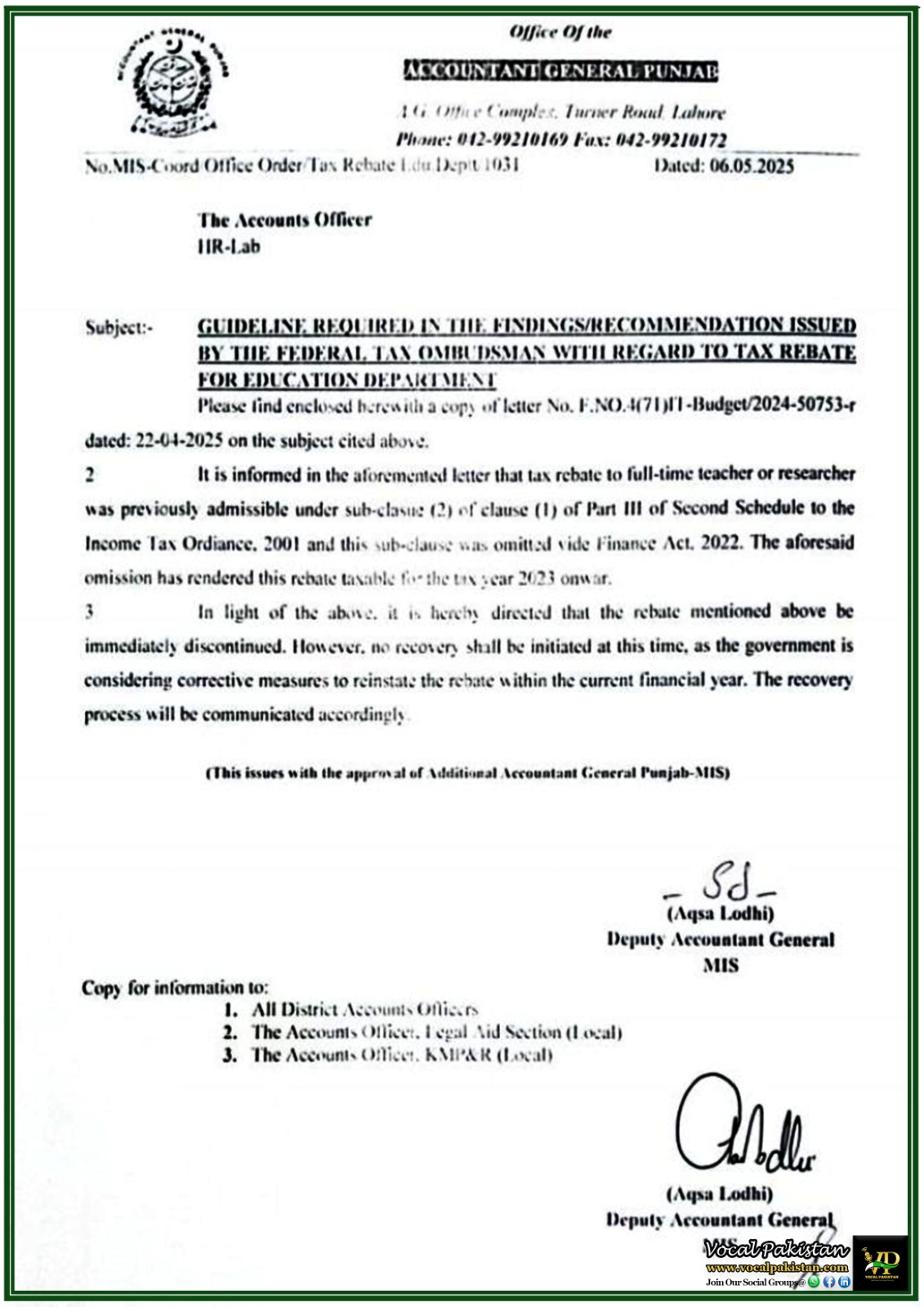

Government of Pakistan

Finance Division

(Regulations Wing)

No. F. 9(3)/Reg.6/2024-264

Islamabad, the 3rd January, 2025

OFFICE MEMORANDUM

Subject :- SPECIAL FAMILY PENSION

VOLUNTARY RETIREMENT PENALTIES

The undersigned is directed to refer Finance Division’s O.M. No. F. 9(3)R-6/2024-264 dated: on the above subject(s) and it is inform that different organizations/departments have raised number of queries for necessary clarification. The responses to those queries are provided at attached Annex-‘l’ and Annex- ‘Il’ for your information and necessary implementation, please.

Deputy Secretary (R-III)

All Ministries/Divisions/CGA/AGPR/MAG

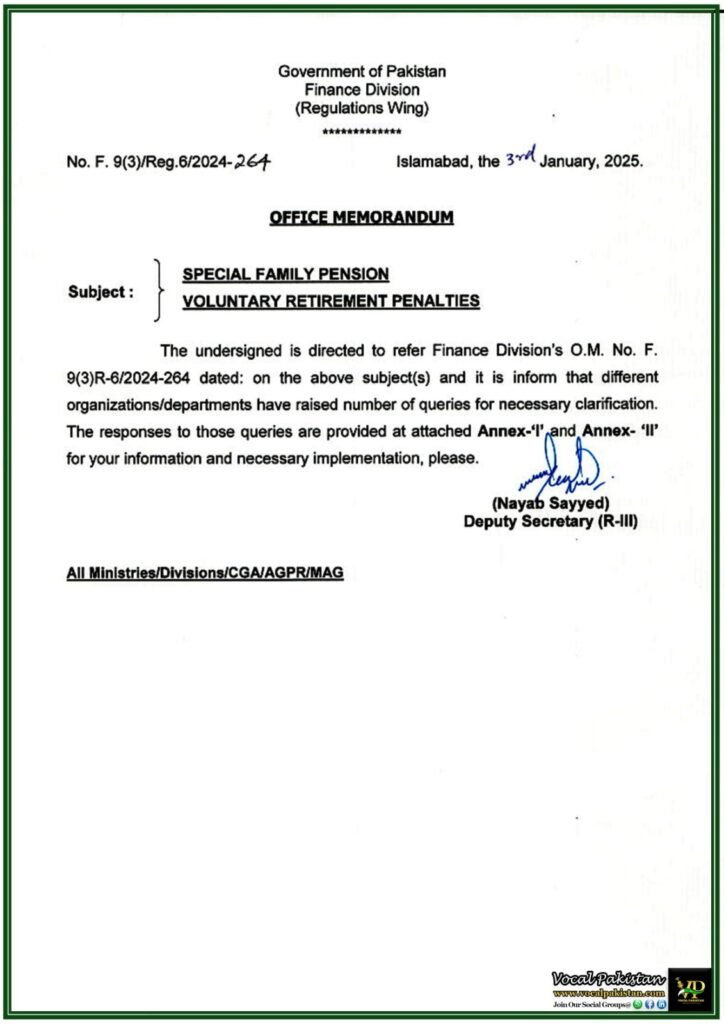

Copy also forwarded for information to:

Web Administrator, Finance Division, Islamabad (for uploading at Finance Division’s Website i.e. (www.finance.gov.pk).

President’s Secretariat (Public), Islamabad.

President’s Secretariat (Personal), Islamabad.

Prime Minister’s Office (Internal), Islamabad.

Prime Minister’s Office (Public), Islamabad.

National Assembly Secretariat, Islamabad.

Senate Secretariat, Islamabad.

Election Commission of Pakistan, Islamabad.

Supreme Court of Pakistan, Islamabad.

Federal Shariat Court, Islamabad.

AGPR, Islamabad/Lahore/Peshawar/Karachi/Quetta.

Pakistan Mint, Lahore.

Auditor General of Pakistan, Islamabad.

Federal Public Service Commission, F-5/1, Agha Khan Road, Islamabad.

Capital Development Authority, Islamabad.

Cost Accounts Organization, Islamabad.

Military Accountant General, Rawalpindi.

Central Directorate of National Savings, Islamabad.

Chief Accounts Officer, M/O Foreign Affairs, Islamabad.

Chief Accounts Officer, Pakistan Railways, Lahore.

All Joint Secretaries (Exp)/Deputy Secretaries(Exp), Finance Division, attached to Ministries/Divisions etc.

Secretariat Training Institute, Islamabad.

Federal Tax Ombudsman’s Secretariat, Islamabad.

DG, Post Offices, Islamabad.

Office of the Chief Commissioner, Islamabad.

Secretary, Wafaqi Mohtasib (Ombudsman)’s Secretariat, Islamabad.

Pakistan Atomic Energy Commission, Islamabad.

All Chief Secretaries/Finance Secretaries of the Government of Punjab/Sindh/ Khyber Pakhtun Khwa/Baluchistan/Azad Government of Jammu & Kashmir & Gilgit Baltistan.

Directorate General of Inspection & Training, Customs & Central Excise, 8th Floor, New Custom House, Karachi.

Earthquake Re-construction and Rehabilitation Authority (ERRA), Islamabad.

National Accountability Bureau, Islamabad.

Intelligence Bureau, Islamabad.

Member (Finance), KRL, P.O Box #1384, Islamabad.

Controller General of Accounts, Sector G-5/2, Islamabad.

Governor, State Bank of Pakistan, Karachi.

President, National Bank of Pakistan, Karachi

PP&A Dte, GHQ and Joint Staff, Headquarter, Rawalpindi.

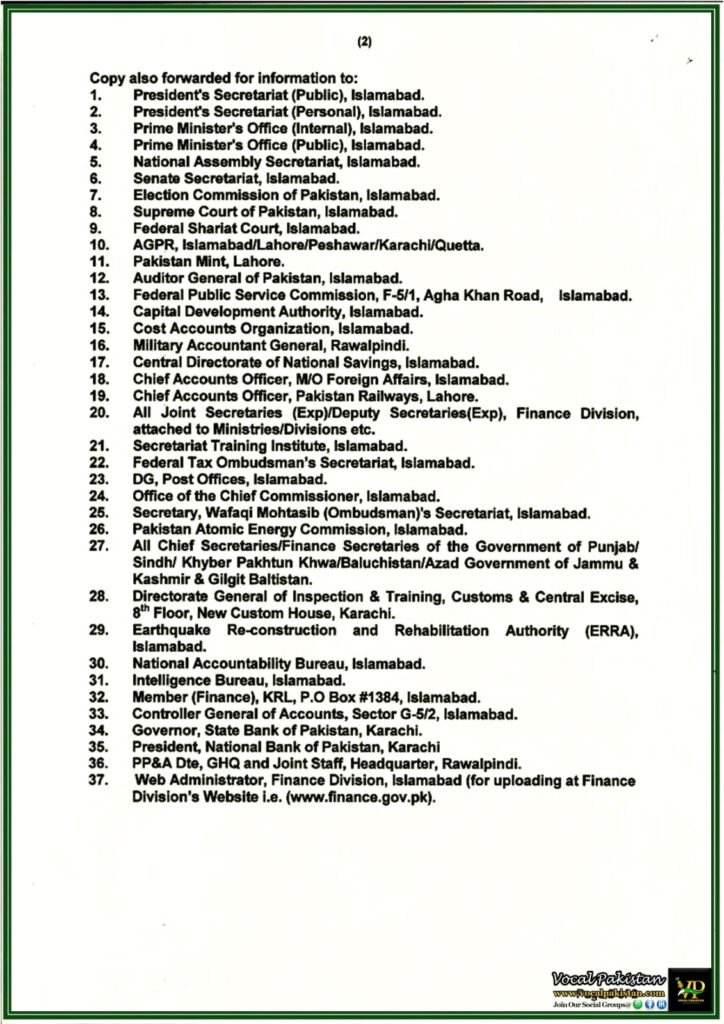

Annex-I

Subject: Special Family Pension

| Sr. No. | QUESTIONs | Clarification of Finance Division |

| a) | i. The terms Special Family Pension need to be defined. ii. What is the eligibility criterion for Special Family Pension. | The Special Family Pension as used in Finance Division O.M.dated 10.09.2024 is admissible to Shuhada of Armed Forces/Civil Armed Forces only. |

| b) | i. In case of the widowed/divorced daughters become entitled to draw such pension for full 25 years or un-expired portion of 25 years. ii. Whether the said O.M. is also applicable on unmarried/widowed/divorced daughters, who are fully dependent on pensioners/ parents. | The Special Family Pension after the death or ineligibility of the spouse/first recipient shall remained admissible for accumulated period of 25 years only, to the family members as per eligibility criteria, share of Special family pension, priority and manner set in Pension Regulations Vol-I (Armed Forces), 2010 |

| c) | i. Whether this OM is also applicable on existing special family pensioners/recipients who are second recipients and have already completed 25 years or more. Whether their pension may be discontinued w.e.f. 10.09.2024 or 25 years are counted from the date of this OM. ii. Whether the pension of unmarried/ widow / divorced daughters who have already drawn their pension for more than 25 years as on 10-09-2024 i.e. issuance of ibid OM, would be stopped or otherwise. iii. Whether the defined period i.e. 25 years for second recipient be considered retrospectively? If yes, how much period will be considered retrospective effect? | i. The condition of 25 years is not applicable to existing Special Family Pensioners who shall be treated as per the terms and conditions under which they were originally granted Special Family Pension. However, the rate revised under para 1(iii) of Finance Division’s O.M. dated 10.09.2024 will be admissible to existing Special Family Pensioners 10.09.2024. ii. As above iii. As above |

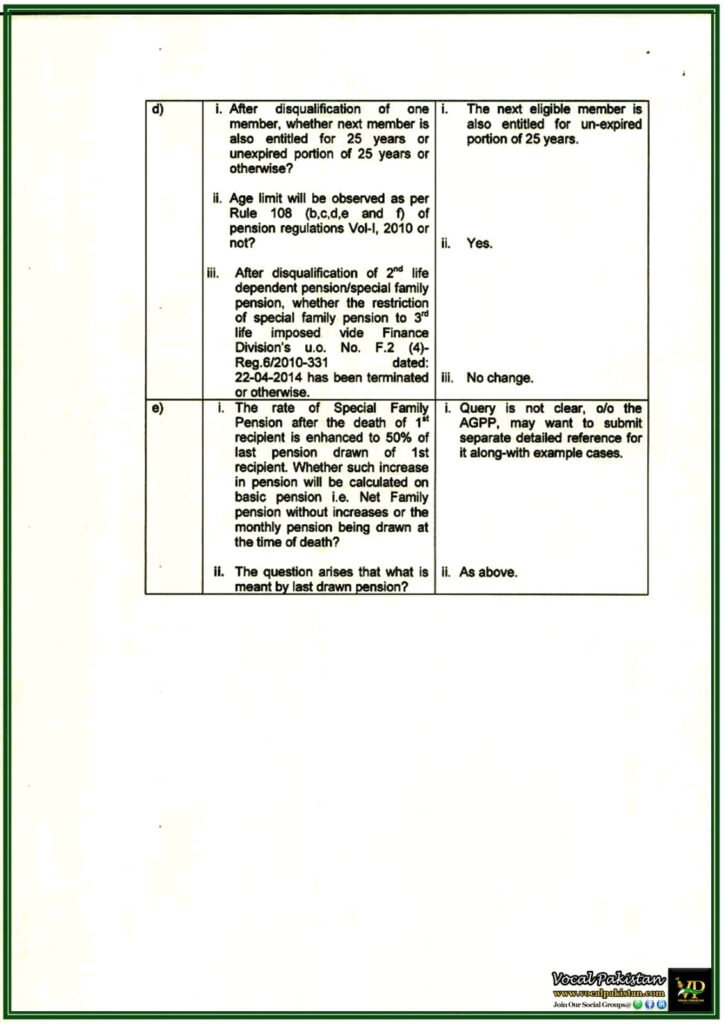

| d) | i. After disqualification of one member, whether next member is also entitled for 25 years or unexpired portion of 25 years or otherwise? ii. Age limit will be observed as per Rule 108 (b,c,d,e and f) of pension regulations Vol-I, 2010 or not? iii. After disqualification of 2nd life dependent pension/special family pension, whether the restriction of special family pension to 3rd life imposed vide Finance Division’s u.o. No. F.2 (4)-Reg.6/2010-331 dated 22-04-2014 has been terminated or otherwise. | i. The next eligible member is also entitled for un-expired portion of 25 years. ii. Yes iii. No change |

| e) | i. The rate of Special Family Pension after the death of 1st recipient is enhanced to 50% of last pension drawn of 1st recipient. Whether such increase in pension will be calculated on basic pension i.e. Net Family pension without increases or the monthly pension being drawn at the time of death? ii. The question arises that what is meant by last drawn pension? | i. Query is not clear, o/o the AGPP, may want to submit separate detailed reference for it along-with example cases. ii. As above. |

Annex-II

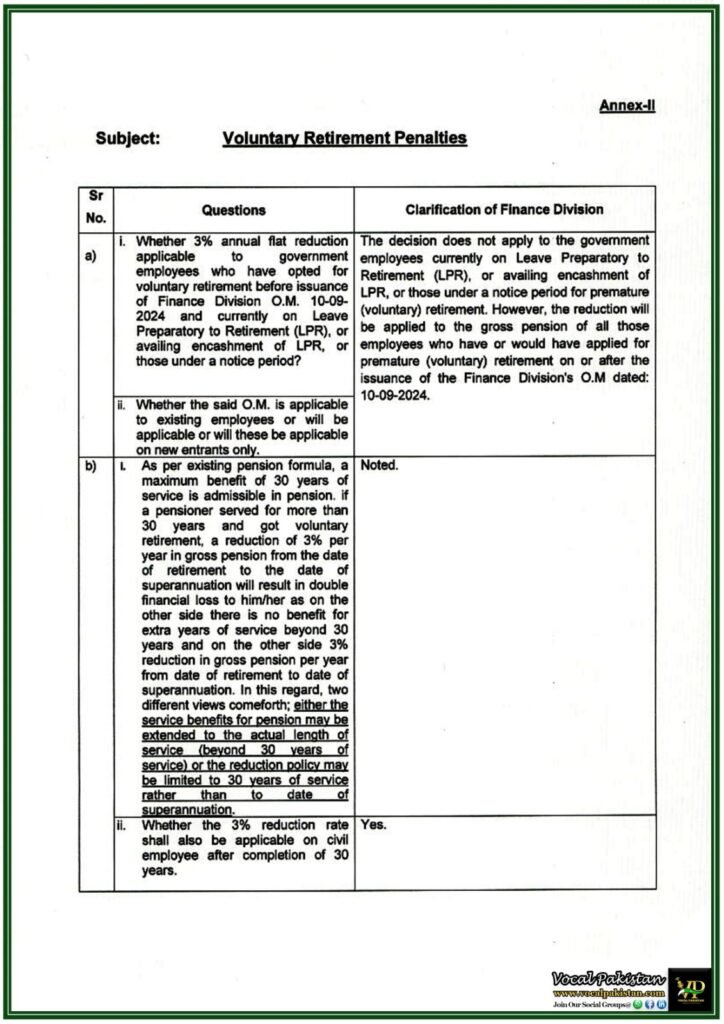

Subject: Voluntary Retirement Penalties

| Sr. No. | QUESTIONs | Clarification of Finance Division |

| a) | i. Whether 3% annual flat reduction applicable to government employees who have opted for voluntary retirement before issuance of Finance Division O.M. 10-09-2024 and currently on Leave Preparatory to Retirement (LPR), or availing encashment of LPR, or those under a notice period? ii. Whether the said O.M. is applicable to existing employees or will be applicable or will these be applicable on new entrants only. | The decision does not apply to the government employees currently on Leave Preparatory to Retirement (LPR), or availing encashment of LPR, or those under a notice period for premature (voluntary) retirement. However, the reduction will be applied to the gross pension of all those employees who have or would have applied for premature (voluntary) retirement on or after the issuance of the Finance Division’s O.M dated: 10-09-2024. |

| b) | i. As per existing pension formula, a maximum benefit of 30 years of service is admissible in pension. If a pensioner served for more than 30 years and got voluntary retirement, a reduction of 3% per year in gross pension from the date of retirement to the date of superannuation will result in double financial loss to him/her as on the other side there is no benefit for extra years of service beyond 30 years and on the other side 3% reduction in gross pension per year from date of retirement to date of superannuation. In this regard, two different views comeforth; either the service benefits for pension may be extended to the actual length of service (beyond 30 years of service) or the reduction policy may be limited to 30 years of service rather than to date of superannuation. | Noted. |

| ii. Whether the 3% reduction rate shall also be applicable on civil employee after completion of 30 years. | Yes. | |

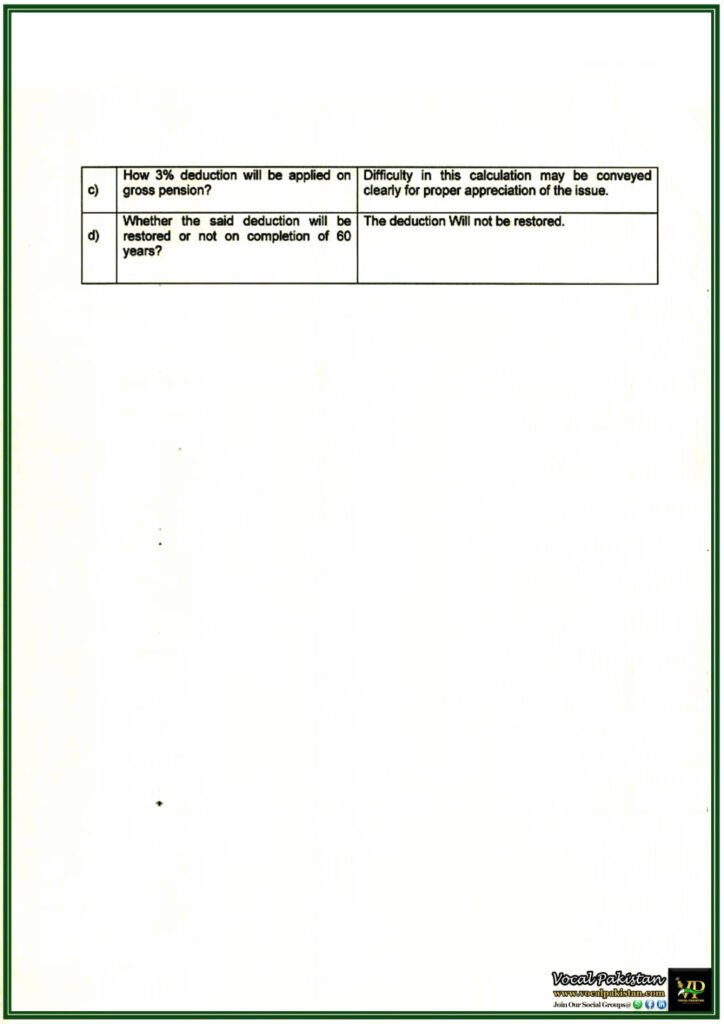

| c) | How 3% deduction will be applied on gross pension? | Difficulty in this calculation may be conveyed clearly for proper appreciation of the issue. |

| d) | Whether the said deduction will be restored or not on completion of 60 years. | The deduction will not be restored. |

Conclusion:

This notification serves as a comprehensive guideline to address the queries and concerns raised by various departments regarding the revised policies on Special Family Pension and Voluntary Retirement Penalties. The clarifications provided in Annex-I and Annex-II aim to standardize the interpretation and application of these policies, ensuring consistency and fairness across the public sector. The Finance Division emphasizes the importance of adhering to these guidelines to uphold transparency and accountability in financial matters.

The document further highlights the Finance Division’s proactive approach in addressing complex regulatory challenges. It reassures all stakeholders, including employees, pensioners, and dependents, that their concerns are acknowledged and addressed within the framework of established regulations. As the policies outlined in this notification are implemented, all relevant ministries, divisions, and organizations are encouraged to review and integrate these clarifications in their operational processes. This approach not only facilitates seamless governance but also reinforces the government’s commitment to safeguarding the welfare of its employees and their families.

For more information, clarification or any other question feel free to join our WhatsApp Group. We are a supportive community where members are committed to assisting one another.