No. F. 9(3)/Reg.6/2024-264

04-March-2025

Regulations Wing, Finance Division, Government of Pakistan

Understanding the Latest Pension Rules – Important Update for Government Employees:

The Government of Pakistan has issued an important notification regarding the calculation of emoluments for pension, multiple pensions, and future pension increases. This notification, released by the Finance Division (Regulations Wing) on March 4, 2025, clarifies various queries raised by government employees and departments.

As per the latest Pension Calculation Rules 2025, the government has introduced new guidelines for calculating average emoluments for pension purposes, handling multiple pensions, and determining future pension increases. The notification also addresses concerns related to voluntary retirement, superannuation, and family pensions. These clarifications are crucial for all government employees, especially those nearing retirement. Notification Describes;

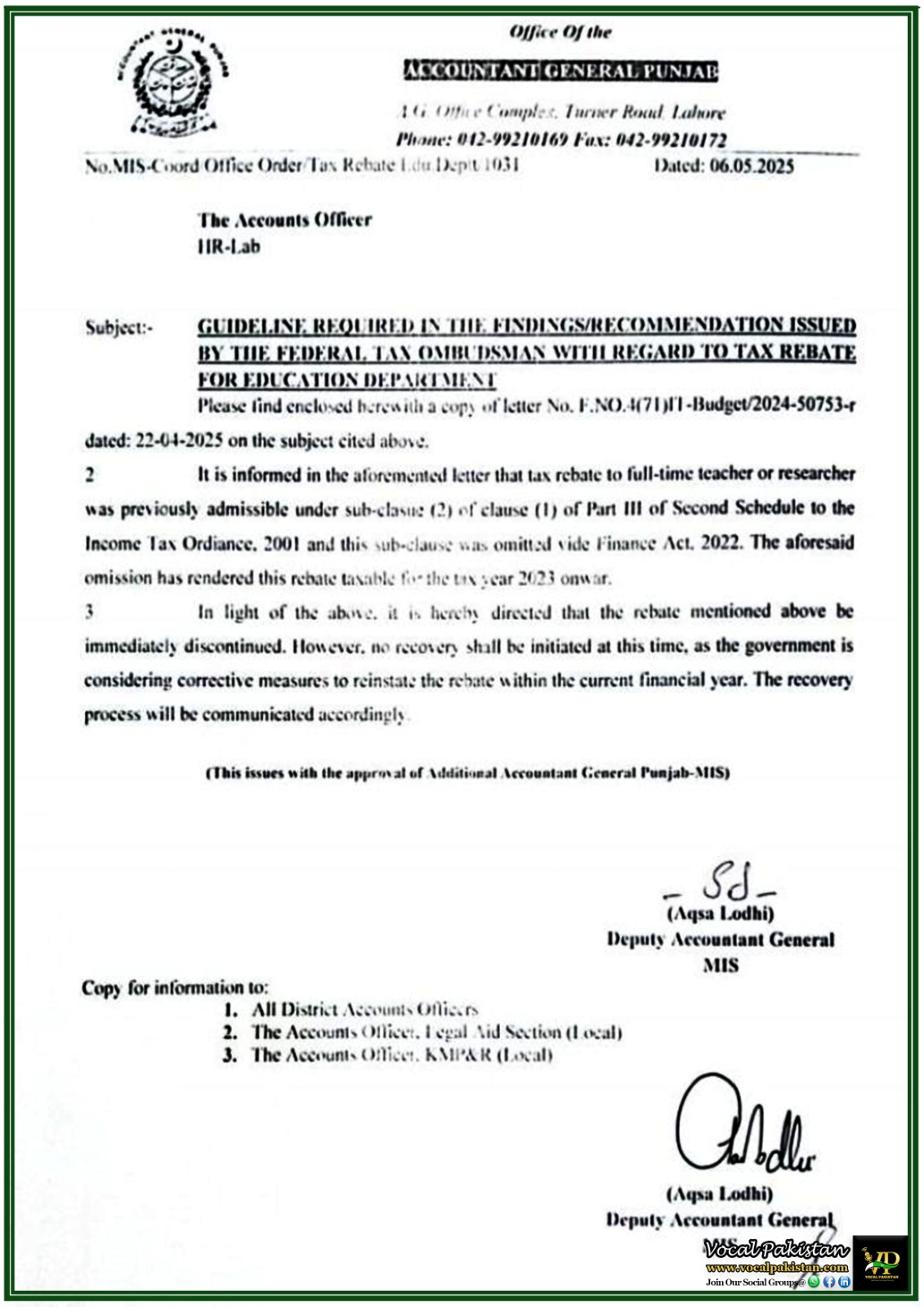

Government of Pakistan

Finance Division

(Regulations Wing)

No. F. 9(3)/Reg.6/2024-264

Islamabad, the 4th March, 2025

OFFICE MEMORANDUM

SUBJECT: CALCULATION OF EMOLUMENTS FOR THE PURPOSE OF PENSION

MULTIPLE PENSIONS

FUTURE INCREASE METHODOLOGY IN PENSION

The undersigned is directed to refer to Finance Division’s O.Ms. No. F. 9(3)R-6/2024-401 to 403 dated: 01.01.2025 on the above subject(s) and to state that various queries have been raised from different quarters for necessary clarification. The responses to those queries are provided at attached Annex-‘I’, Annex- ‘II’ and Annex-‘III’ for information and necessary implementation of all, please.

Deputy Secretary (R-III)

All Ministries/Divisions/CGA/AGPR/MAG

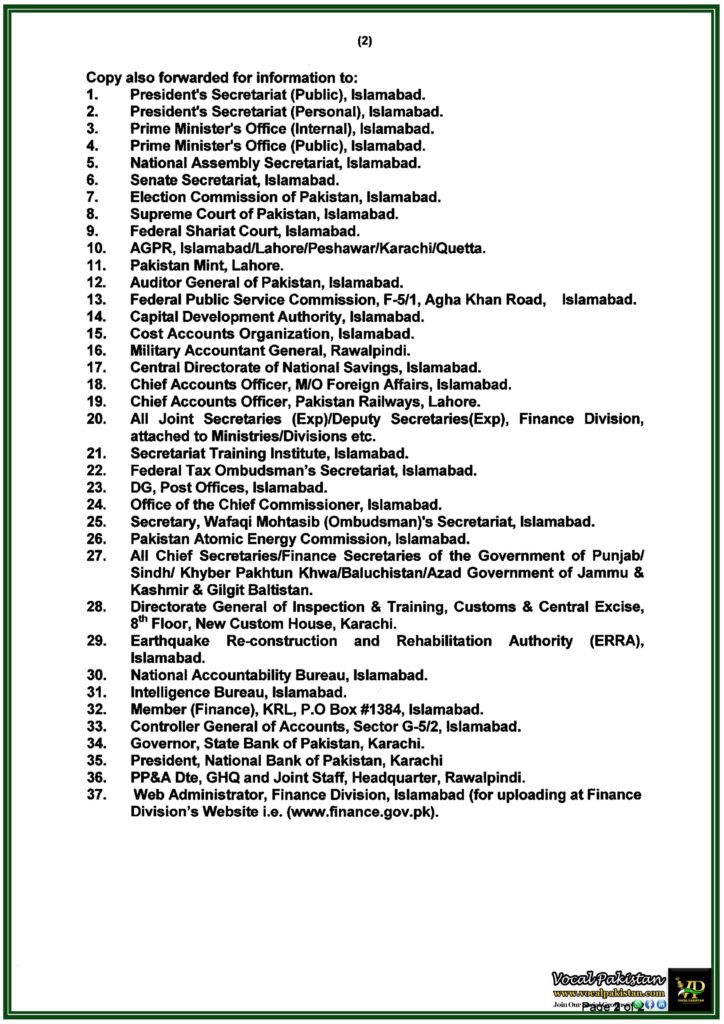

Annex-I

CALCULATION OF EMOLUMENTS FOR THE PURPOSE OF PENSION

| S.No. | Query | Clarification |

| 1 | i) Whether benefit of usual/notional increment on completion of six months service in the year of retirement/death shall be counted to calculate average emoluments drawn during last 24 months or otherwise? (IB Division) Whether Notional/Retiring Year Increment/Usual Increment for Pension Purpose would be added after calculating the average of 24 months emoluments or otherwise? (Estab. Division) (ii) How the current charge allowance shall be counted calculate average pensionable emoluments drawn during last 24 months. | Terms “Emoluments” and “Average Emoluments” are defined in Article 486 CSR and Article 487 CSR respectively. As the usual increment upon completion of six months in the year of retirement neither part of emoluments nor has been drawn by the Government servant during last 24 months. It is therefore, clarified that the benefit of said usual increment in the year of retirement shall not be calculated as average of the emoluments, instead it may be added up after calculating average emoluments for pension purpose only. However, said increment will be admissible as per existing rules. In terms of Article 486 CSR, the emoluments defined/classed as pay only (other than Senior Post Allowance) will be termed as emoluments for calculation of pension purpose. Thus, it is clarified that current charge pay shall be counted as average pensionable emoluments. |

| 2 | Whether subject decision is applicable to government employees who have opted for voluntary retirement before issuance of Finance Division O.M. 01.01.2025 or going to be superannuation and currently on Leave Preparatory to Retirement (LPR), or availing encashment of LPR, or those under a notice period? If applicable, then in case of employees going to be superannuated/retired on 31.12.2024 (being last day of his service), whether his pension may be calculated on basis of average emoluments of last 24 months or otherwise? | The decision is not applicable to the government employees currently on Leave Preparatory to Retirement (LPR), or availing encashment of LPR, or those under a notice period for premature (voluntary) retirement. |

| 3 | Whether, if, a government employees retires in the start/middle of a month, his ten 10/fifteen (15)/twenty (20) days period would be considered as full month for calculating the 24 months average emoluments or otherwise? | It is clarified that fraction, if any, shall be counted as full month while calculating average emoluments. |

Annex-II

MULTIPLE PENSIONS

| S.No. | Query | Clarification |

| 1. | Whether the condition to opt one pension is applicable to those who have already drawing more than one pension prior to issuance of said O.M. or otherwise? ii) Whether the condition to opt one pension is applicable to both self and family pension or otherwise? | No. the decision is not applicable to Federal Government employees who are drawing multiple pensions prior to issuance of O.M. F.No.9(3)R-6/2024-402 dated: 01.01.2025 on the subject. However, condition to opt one pension will be applied to Government employees who got re-employment on or after 01.01.2025. The point already defined at sub-para (ii) of O.M. F. No. 9(3)R.6/2024-402 dated: 01.01.2025 on the subject. |

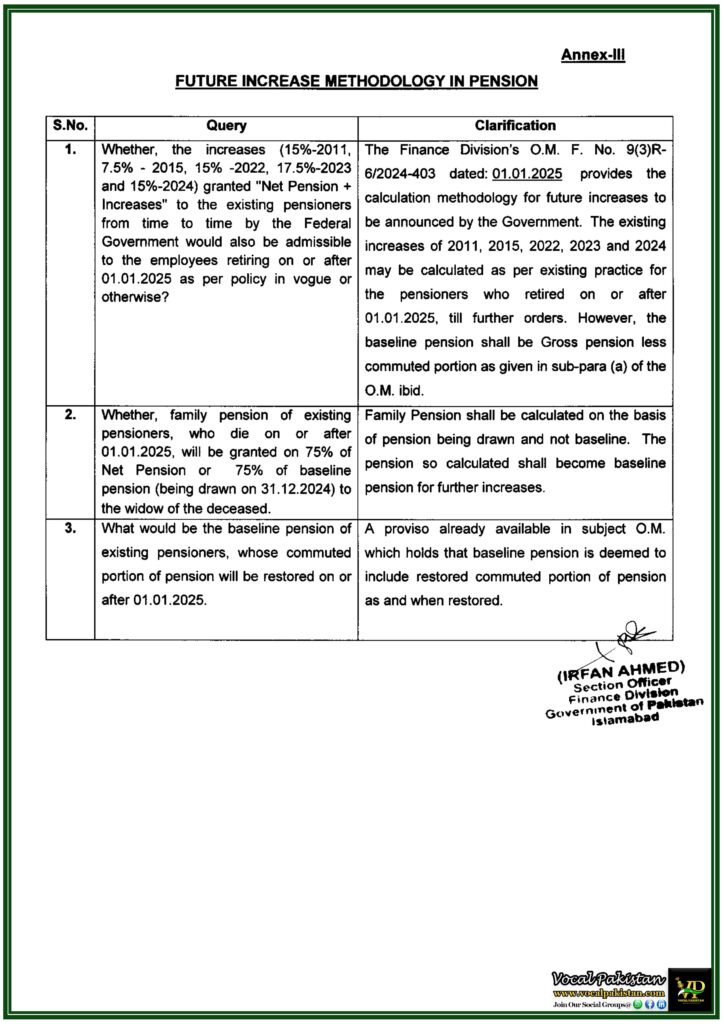

Annex-III

FUTURE INCREASE METHODOLOGY IN PENSION

| S.No. | Query | Clarification |

| 1 | Whether, the increases (15%-2011, 7.5% -2015, 15% -2022, 17.5%-2023 and 15%-2024) granted “Net Pension + Increases” to the existing pensioners calculation methodology for future increases to from time to time by the Federal Government would also be admissible to the employees retiring on or after 01.01.2025 as per policy in vogue or otherwise? | The Finance Division’s O.M. F. No. 9(3)R- 6/2024-403 dated: 01.01.2025 provides the calculation methodology for future increase to be announced by the Government. The existing increases of 2011, 2015, 2022, 2023 and 2024 may be calculated as per existing practice for the pensioners who retired or after 01.01.2025, till further orders. However, the baseline pension shall be Gross pension less commuted portion as given in sub-para (a) of the O.M. ibid. |

| 2 | Whether, family pension of existing pensioners, who die on or after 01.01.2025, will be granted on 75% of Net Pension or 75% of baseline pension (being drawn on 31.12.2024) to the widow of the deceased. | Family Pension shall be calculated on the basis of pension being drawn and not baseline. The pension so calculated shall become baseline pension for further increases. |

| 3 | What would be the baseline pension of existing pensioners, whose commuted portion of pension will be restored on or after 01.01.2025. | A proviso already available in subject O.M. which holds that baseline pension is deemed to include restored commuted portion of pension as and when restored. |

What These New Pension Rules Mean for Government Employees:

The 2025 Pension Rules Notification introduces significant changes, and government employees should be well aware of these updates. Here’s how these new policies may impact you:

🔹 Plan Your Retirement Wisely: If you are nearing retirement, ensure you understand the new emolument calculation method to maximize your pension benefits.

🔹 Multiple Pensions Rule: If you are re-employed after retirement, note that the “one pension only” condition now applies to new cases after January 1, 2025.

🔹 Future Pension Increases: The baseline pension concept has been clarified, affecting how future pension increments will be calculated for retirees after 2025.

For existing pensioners, the methodology for calculating pension increases remains unchanged, but it is crucial to stay informed about any future amendments.

For more information, clarification or any other question feel free to join our WhatsApp Group. We are a supportive community where members are committed to assisting one another.