Notification / OM No.

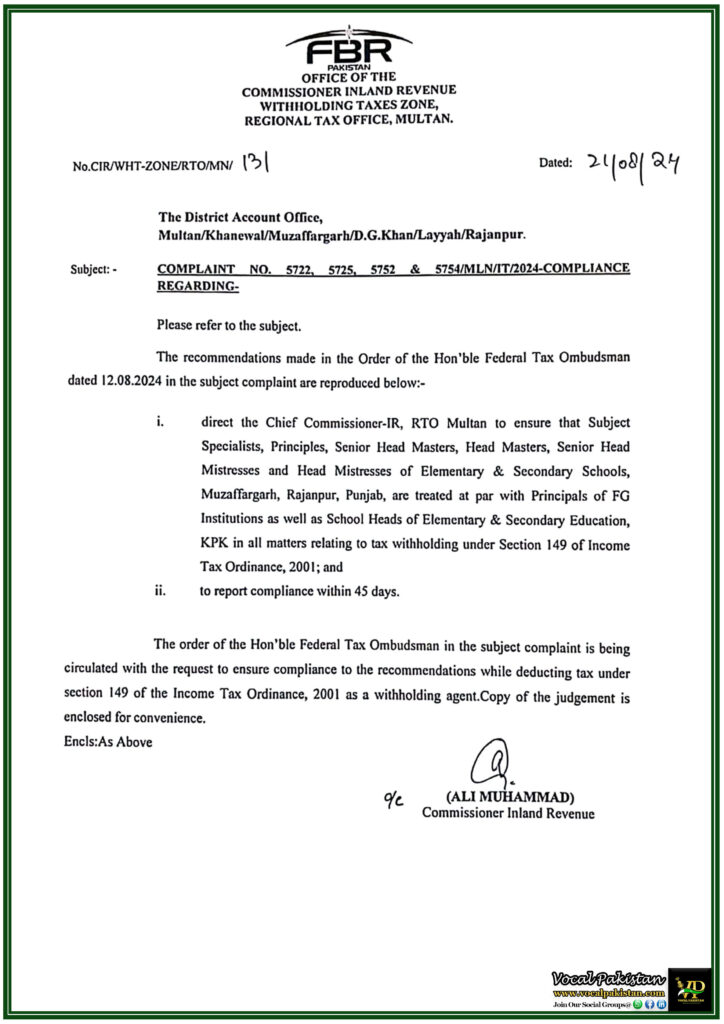

No.CIR/WHT-ZONE/RTO/MN/131

Dated:

21-August-2024

Notification Issued By:

FBR, Office Of The Commissioner Inland Revenue Withholding Taxes Zone, Regional Tax Office, Multan

FBR OFFICE OF THE

COMMISSIONER INLAND REVENUE

WITHHOLDING TAXES ZONE,

REGIONAL TAX OFFICE, MULTAN.

No.CIR/WHT-ZONE/RTO/MN/131 Dated: 21/08/2024

The District Account Office,

Multan/Khanewal/Muzaffargarh/D.G.Khan/Layyah/Rajanpur.

Subject:- COMPLAINT NO. 5722, 5725, 5752 & 5754/MLN/IT/2024-COMPLIANCE REGARDING-

Please refer to the subject.

The recommendations made in the Order of the Hon’ble Federal Tax Ombudsman dated 12.08.2024 in the subject complaint are reproduced below:-

- direct the Chief Commissioner-IR, RTO Multan to ensure that Subject Specialists, Principles, Senior Head Masters, Head Masters, Senior Head Mistresses and Head Mistresses of Elementary & Secondary Schools, Muzaffargarh, Rajanpur, Punjab, are treated at par with Principals of FG Institutions as well as School Heads of Elementary & Secondary Education, KPK in all matters relating to tax withholding under Section 149 of Income Tax Ordinance, 2001; and

- to report compliance within 45 days.

The order of the Hon’ble Federal Tax Ombudsman in the subject complaint is being circulated with the request to ensure compliance to the recommendations while deducting tax under section 149 of the Income Tax Ordinance, 2001 as a withholding agent. Copy of the judgment is enclosed for convenience.

Encls:As Above

Commissioner Inland Revenue