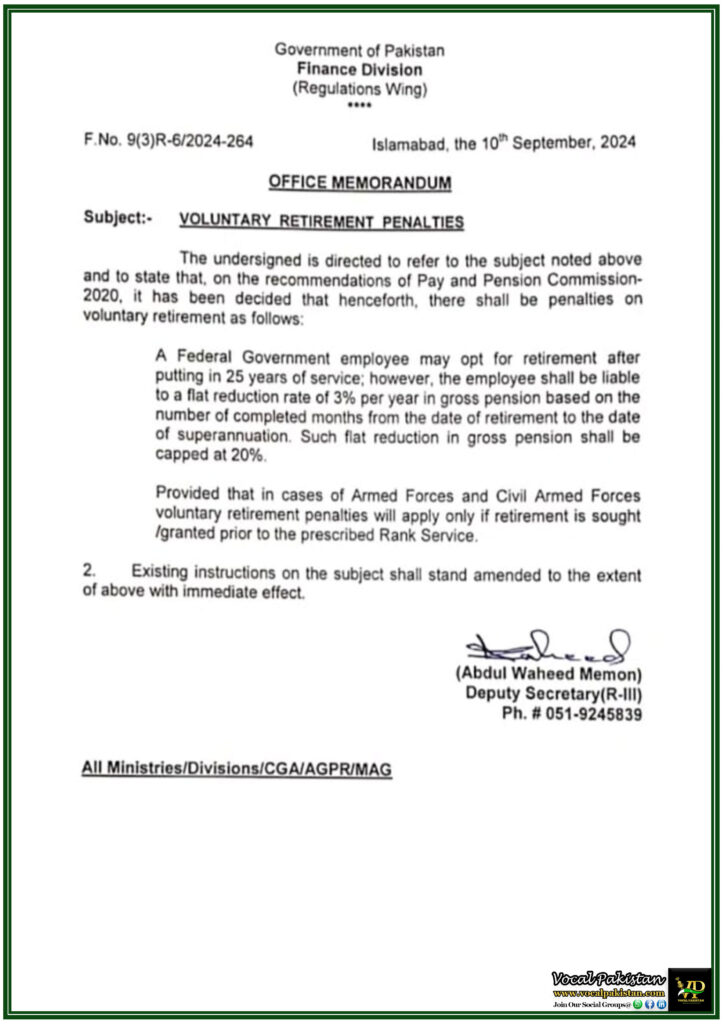

Notification / OM No.

F. No. 9(3)R-6/2024-264

Dated:

10-September-2024

Notification Issued By:

Regulations Wing, Finance Division, Government of Pakistan

Government of Pakistan

Finance Division

(Regulations Wing)

F. No. 9(3)R-6/2024-264 Islamabad, the 10th September, 2024

OFFICE MEMORANDUM

Subject:- VOLUNTARY RETIREMENT PENALTIES

The undersigned is directed to refer to the subject noted above and to state that, on the recommendations of Pay and Pension Cornmission2020, it has been decided that henceforth, there shall be penalties an voluntary retirement as follows:

A Federal Government employee may opt for retirement after putting in 25 years of service, however, the employee shall be liable to a flat reduction rate of 3% per year in gross pension based on the number of completed months from the date of retirement to the date of superannuation Such flat reduction in gross pension shall be capped at 20%.

Provided that in cases of Armed Forces and Civil Armed Forces voluntary retirement penalties will apply only if retirement is sought /granted prior to the prescribed Rank Service.

2. Existing instructions on the subject shall stand amended to the extent of above with immediate effect.ctions on the subject shall stand amended to the extent of above with immediate effect.

Deputy Secretary(R-III)

All Ministries/Divisions/CGA/AGPR/MAG