Notification / OM No.

No.FD.SR.IV/1-25/2020

Dated:

17-October-2023

Notification Issued By:

FINANCE DEPARTMENT, GOVERNMENT OF THE PUNJAB

No.FD.SR.IV/1-25/2020

GOVERNMENT OF THE PUNJAB

FINANCE DEPARTMENT

Dated: Lahore, the 17th October, 2023

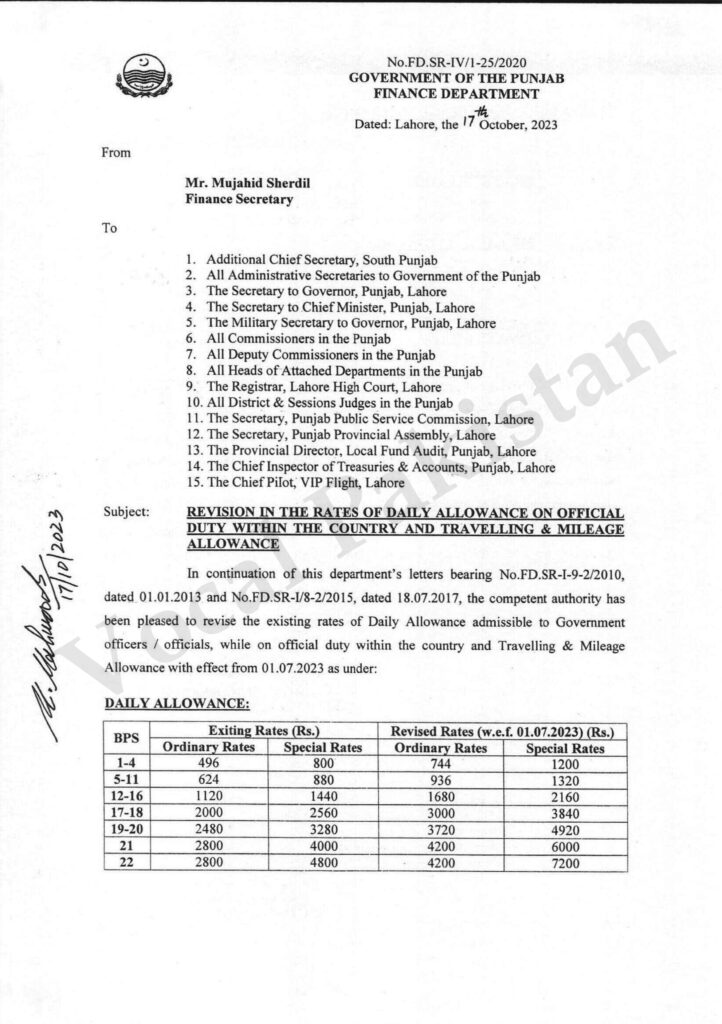

SUBJECT: REVISION IN THE RATES OF DAILY ALLOWANCE ON OFFICIALDUTY WITHIN THE COUNTRY AND TRAVELLING & MILEAGE ALLOWANCE

In continuation of this department’s letters bearing No.FD.SR-I-9-2/2010, dated 01.01.2013 and No.FD.SR-I/8-2/2015, dated 18.07.2017, the competent authority has been pleased to revise the existing rates of Daily Allowance admissible to Government officers / officials, while on official duty within the country and Travelling & Mileage Allowance with effect from 01.07.2023 as under:

DAILY ALLOWANCE:

| BPS | Exiting Rates (Rs.) | Revised Rates (w.e.f. 01.07.2023) (Rs.) | ||

| Ordinary Rates | Special Rates | Ordinary Rates | Special Rates | |

| 1-4 | 496 | 800 | 744 | 1200 |

| 5-11 | 624 | 880 | 936 | 1320 |

| 12-16 | 1120 | 1440 | 1680 | 2160 |

| 17-18 | 2000 | 2560 | 3000 | 3840 |

| 19-20 | 2480 | 3280 | 3720 | 4920 |

| 21 | 2800 | 4000 | 4200 | 6000 |

| 22 | 2800 | 4800 | 4200 | 7200 |

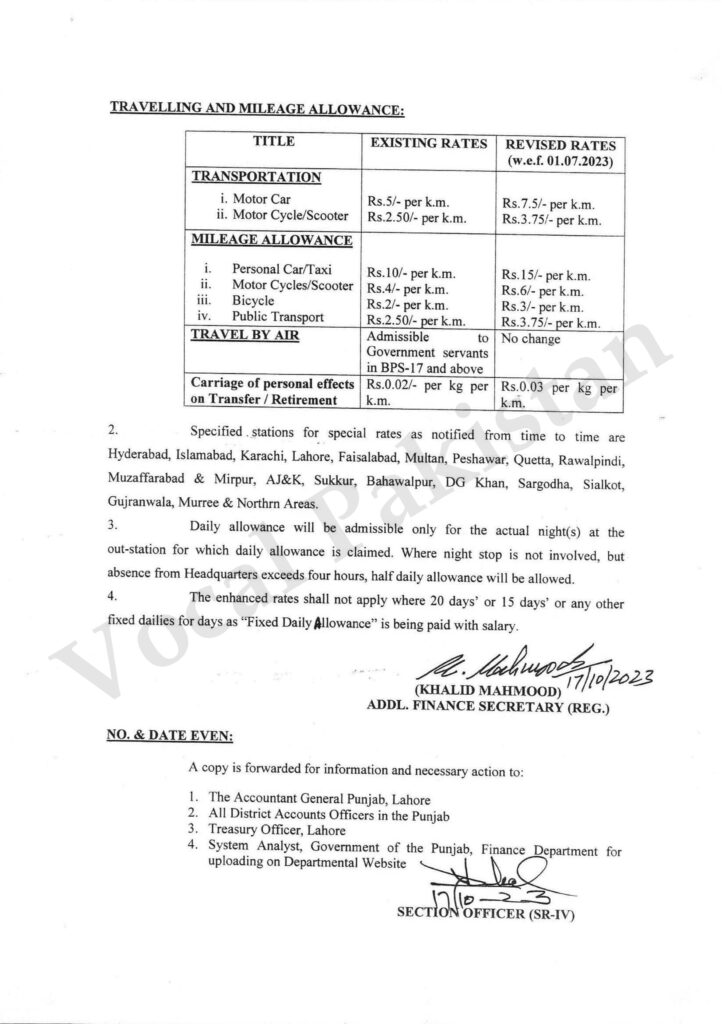

TRAVELLING AND MILEAGE ALLOWANCE:

| TITLE | EXISTING RATES | REVISED RATES (w.e.f. 01.07.2023) |

| TRANSPORTATION i. Motor Car ii. Motor Cycle/Scooter | Rs.5/- per k.m. Rs.2.50/- per k.m. | Rs.7.5/- per k.m. Rs.3.751- per k.m. |

| MILEAGE ALLOWANCE Personal Car/TaxiMotor Cycles/ScooterBicycle iv. Public Transport | Rs.10/- per k.m. Rs.4/- per k.m. Rs.2/- per k.m. Rs.2.50/- per k.m. | Rs.15/- per k.m. Rs.6/- per k.m. Rs.3/- per k.m. Rs.3.751- per k.m. |

| TRAVEL BY AIR | Admissible to Government servants in BPS-17 and above | No change |

| Carriage of personal effects on Transfer / Retirement | Rs.0.02/- per kg per k.m. | Rs.0.03 per kg per k.m. |

- Specified stations for special rates as notified from time to time are Hyderabad, Islamabad, Karachi, Lahore, Faisalabad, Multan, Peshawar, Quetta, Rawalpindi, Muzaffarabad & Mirpur, AJ&K, Sukkur, Bahawalpur, DG Khan, Sargodha, Sialkot, Gujranwala, Murree & Northrn Areas.

- Daily allowance will be admissible only for the actual night(s) at the out-station for which daily allowance is claimed. Where night stop is not involved, but absence from Headquarters exceeds four hours, half daily allowance will be allowed.

- The enhanced rates shall not apply where 20 days’ or 15 days’ or any other fixed dailies for days as “Fixed Daily Allowance” is being paid with salary.

ADDL. FINANCE SECRETARY (REG.)