No.FD-SR-III-4-239/2023

19-February-2025

Finance Department, Government Of The Punjab

Punjab’s New Pension Scheme 2025 – What It Means for Government Employees:

In a significant move towards pension reform, the Punjab Government has officially announced the Punjab Defined Contribution Pension Scheme Rules 2025 through a formal notification. This new scheme is set to redefine the pension structure for newly appointed government employees, ensuring a sustainable retirement fund model.

Under this scheme, both employees and the government will contribute to a dedicated pension account, which will be invested through approved pension fund managers. Employees will have the choice between conventional and Shariah-compliant investment options, allowing flexibility in financial planning for retirement.

This reform aims to modernize the pension system by aligning it with international best practices, ensuring financial security for employees while reducing the long-term burden on the provincial government. The new rules apply to civil servants hired after the enactment of the Punjab Civil Servants (Amendment) Ordinance 2023 and those regularized under new government policies.

The notification details the governance, contribution structure, roles of employees and employers, and fund management policies to be followed under the new pension scheme. Please find the official notification below:

GOVERNMENT OF THE PUNJAB

FINANCE DEPARTMENT

Dated: Lahore, the 19th February,2025

Notification

No.FD-SR-III-4-239/2023. In exercise of the powers conferred under section 23 of the Punjab Civil Servants Act, 1974 (VIII of 1974), Governor of the Punjab is pleased to make the following rules:

1. Short title, commencement and application.- (1) These rules may be cited as the Punjab Defined Contribution Pension Scheme Rules 2025.

(2) They shall come into force at once.

(3) They shall apply to all the employees mentioned in clause (g) of sub-rule (1) of rule 2 of the rules.

2. Definitions.- (1) In the rules, unless the subject or context requires otherwise:

(a) “Accountant General” means the Accountant General, Punjab;

(b) “Act” means the Punjab Civil Servants Act, 1974 (VIII of 1974);

(c) “allocation policy” means allocation of contributions, in various sub-funds of an employer pension fund, in accordance with the rules and governed by the Voluntary Pension System Rules, 2005 and the Non- Banking Finance Companies Regulations, 2008;

(d) “conventional fund” means a type of employer pension fund, to be managed by the Eligible Pension Fund Manager, in a conventional manner, in accordance with the Voluntary Pension System Rules, 2005;

(e) “Defined Contribution Pension Scheme” means the Defined Contribution Pension Scheme as specified in section 18-A of the Act and the rules and governed in accordance with the Voluntary Pension System Rules, 2005 and the Non-Banking Finance Companies Regulations, 2008, in which both the employer and employee contribute, as per the First Schedule, to the employee’s pension account, opened with an Eligible Pension Fund Manager of the employee’s choice and such contributions are invested in an employer pension fund, as defined under the Voluntary Pension System Rules, 2005, either in a conventional fund or a Shariah compliant fund, as selected by the employee, until the employee attains retirement age, and the accumulated balance in the pension account at the time of retirement is withdrawn or invested further to generate monthly income during the post- retirement phase, subject to exceptions under the rules;

(f) “Eligible Pension Fund Manager” means a Pension Fund Manager who qualifies the criteria as specified in sub-rule (13) of rule 4 and has entered into an agreement with the employer to establish and manage employer pension funds for the employees;

(g) “employee” means:

(i) a person appointed on or after the commencement of the Punjab Civil Servants (Amendment) Ordinance 2023 (I of 2024) but not including any person who was appointed as Government servant holding pensionable post before the commencement of the said Ordinance, and was subsequently inducted into any Provincial service through proper channel after coming into force of the Punjab Civil Servants (Amendment) Ordinance 2023 (I of 2024); or

(ii) a person regularized as a civil servant through any legal instrument issued on or after the commencement of the Punjab Civil Servants (Amendment) Ordinance 2023 (I of 2024) and shall be considered an employee for the purposes of the rules from the date of issuance of such legal instrument, regardless of the effective date of regularization.

Provided that an employee shall, subject to sub-rule (3) of rule 5 of the rules, be deemed to be an employee solely for the purposes of the Defined Contribution Pension Scheme until reaching retirement age and no further contributions shall be made to his pension account by either the employer or the employee in the event of his leaving service before attaining retirement age for any reason whatsoever.

(h) “employee’s contribution” means the amount computed by multiplying the employee’s pensionable pay with the employee’s contribution rate specified in the First Schedule;

(i) “employer” means the Government;

(j) “employer’s contribution” means the amount computed by multiplying the employee’s pensionable pay with the employer’s contribution rate specified in the First Schedule;

(k) “Finance Department” means the Department, Government of the Punjab;

(l) “overall contribution” means the sum of employer’s contribution and employee’s contribution as per the First Schedule;

(m) “pension account” means an account opened and maintained by an employee with the Eligible Pension Fund Manager as per the Voluntary Pension System Rules, 2005;

(n) “Pension Fund Manager Agreement” means an agreement between the employer and the Eligible Pension Fund Manager for the Defined Contribution Pension Scheme;

(o) “pensionable pay” means the running basic pay but does not include any other pay, allowances or perquisites;

(p) “retirement age” means the retirement age as specified in section 12 of the Act;

(q) “rules” means the Punjab Defined Contribution Pension Scheme Rules 2025;

(r) “salary” means the monthly amount being drawn as pay and allowances by the employee;

(s) “Schedule” means the Schedule appended to the rules; and

(t) “Shariah compliant fund” means a type of employer pension fund, governed by the requirements of Shariah law, to be managed by the Eligible Pension Fund Manager in accordance with the Voluntary Pension System Rules, 2005.

(2) A word or expression used but not defined in the rules shall have the same meaning as assigned to it in the Act and the Voluntary Pension System Rules, 2005.

3. Governance of the Defined Contribution Pension Scheme.- (1) Save as otherwise provided in the rules, the Defined Contribution Pension Scheme shall be governed as per the Voluntary Pension System Rules, 2005 and the Non-Banking Finance Companies Regulations, 2008.

(2) The Defined Contribution Pension Scheme shall be managed through the Eligible Pension Fund Managers.

(3) The balance in pension account including the employer’s contribution and employee’s contribution and the return thereon shall be subject to the rules.

4. Role and responsibilities of the employer.- (1) The Finance Department shall ensure the deduction of employee’s contribution, at source, at the time of payment of each salary to the employee through Accountant General Punjab.

(2) The employer’s contribution shall be in addition to the salary otherwise payable to the employee.

(3) The employer shall not be under any obligation to make any additional contribution or payment for the Defined Contribution Pension Scheme in addition to the rates as mentioned in the First Schedule.

(4) The employer shall ensure budgetary allocations for its contribution and the Finance Department shall release funds in a timely manner, without any exception.

(5) The Accountant General shall transfer the overall contribution in the employee’s pension account at the time of payment of salary to the employee through an automated system implemented and managed by him without any delay.

(6) The Accountant General shall be responsible for the deduction, transfer, accounting and reconciliation of both, the employer’s contribution and employee’s contribution.

(7) The Accountant General shall forward monthly reports to the Punjab Pension Fund regarding the transfer of contributions in accordance with the agreed upon reporting format and timelines.

(8) In the case where salary of an employee is disbursed by an entity owned or controlled by the Government other than the Accountant General or the District Accounts Office, as the case may be, the Drawing and Disbursing Officer of such entity shall deduct the employee’s contribution and deposit the same into the bank account designated by the Accountant General by the monthly date and in the manner as specified by the Accountant General till such time as the salary of such employee begins to be disbursed through the Accountant General or the District Accounts Office, as the case may

be:

Provided that in the event of any delay in depositing the deducted amount, the Drawing and Disbursing Officer shall be personally liable to compensate the employee by making additional contribution to be determined by the Punjab Pension Fund to the employee’s pension account to cover any profit that the employee would have earned or any gain that would have realized by him, had the employee’s contribution been deposited on time.

(9) The Accountant General shall process the first salary of an employee only after receiving the information regarding his pension account as per clause (b) of sub-rule (1) of rule 5 of the rules. Explanation: “First Salary” in this rule shall mean the salary that …shall be disbursed after a person become an employee.

(10) The Accountant General shall provide information regarding the accumulated employee’s contributions and employer’s contributions to date on the employee’s salary slip.

(11) The Accountant General shall compute and deduct income tax from the employee’s salary as per the Income Tax Ordinance, 2001 (XLIX of 2001).

(12) The Accountant General shall not deduct and transfer the overall contribution for any employee whose pension account has not been opened. On opening of his pension account, any outstanding overall contributions for the period commencing from the date he becomes an employee till the date of opening, of his pension account shall be deducted and transferred to his pension account in future months in addition to the regular overall contributions as per the First Schedule:

Provided that such additional overall contribution shall not be more than the regular overall contribution until all the outstanding overall contributions are accounted for.

(13) The employer shall, through Finance Department, enter into the Pension Fund Manager Agreement with each of the Pension Fund Managers who:

(a) is authorized under the Voluntary Pension System Rules, 2005 to manage employer pension funds;

(b) meets the asset manager rating criteria specified in the Voluntary Pension System Rules, 2005;

(c) has systems that support electronic transfer of contributions; and

(d) has applied to the Government to provide services for managing pension fund(s) for its employees in accordance with the rules and the Voluntary Pension System Rules, 2005.

(14) The Pension Fund Manager Agreement shall specify the standard terms and conditions including a mandatory insurance plan providing death and disability risk cover to the employees to be arranged by the Eligible Pension Fund Manager in accordance with the Pension Fund Manager Agreement.

(15) The Finance Department shall notify a list of Eligible Pension Fund Managers and publish it on its website and keep the same updated.

(16) The employer may, through Finance Department, terminate the Pension Fund Manager Agreement with the Eligible Pension Fund Manager in accordance with the terms and conditions as specified in the Pension Fund Manager Agreement.

(17) The Finance Department shall ensure that each Eligible Pension Fund Manager establishes separate pension fund(s) for the Defined Contribution Pension Scheme and each pension fund shall include the sub-funds as specified by the Finance Department.

(18) The Punjab Pension Fund shall:

(a) monitor the Defined Contribution Pension Scheme;

(b) establish and maintain an online portal to facilitate the smooth opening of pension accounts and the ongoing monitoring of the Defined Contribution Pension Scheme, providing a user-friendly interface for employees to open their pension accounts and communicate with the Punjab Pension Fund, and enabling real-time data sharing between the Punjab Pension Fund, the Eligible Pension Fund Managers, and other relevant entities to ensure transparency, efficiency, and effective management of the Defined Contribution Pension Scheme;

(c) require and analyze periodic reports from the Eligible Pension Fund Managers including but not limited to information regarding:

- number of pension accounts;

- number of pension account holders;

- amount of contributions received;

- performance of sub-funds of the pension funds being managed;

- pension account holders who have reached the retirement age and amount withdrawn by such pension account holders; and

- number of employees who have invested in monthly income plans and annuities and amount of monthly profit and annuity paid to such employees;

(d) prepare and disseminate training materials for education of the employees regarding:

- the rules and Voluntary Pension System Rules, 2005;

- selection from among the Eligible Pension Fund Managers;

- opening of pension account;

- setting up online access to pension account;

- choosing or revising allocation policy;

- understanding account statements;

- updating any changes in personal information; and

- transferring pension account from one Eligible Pension Fund Manager to another, etc.;

(e) provide separate updated lists to the Eligible Pension Fund Managers in respect of the employees:

(i) whose pension accounts are to be opened; or

(ii) who have left employment before attaining the retirement age; or

(iii) who have attained the retirement age; or

(iv) who have died before or after attaining the retirement age;

(f) act as an intermediary between the employees and Eligible Pension Fund Managers for opening of pension accounts and performing necessary tasks in this respect, including obtaining the information required for opening of pension account from the employees according to the template jointly developed by the Eligible Pension Fund Managers, sharing the information with Eligible Pension Fund Managers, resolving any discrepancies or deficiencies and ensuring that the pension accounts are opened as soon as practicable;

(g) ensure that only one designated pension account of each employee is recorded with the Accountant General;

(h) facilitate the employees in resolution of any issue such as updating of personal information, using online services, understanding their account statements and notifying the pension account holder about the termination or cancellation of the Pension Fund Manager Agreement with an Eligible Pension Fund Manager by the employer, etc.;

(i) coordinate with relevant stakeholders for resolving any issue that may arise in connection with the Defined Contribution Pension Scheme;

(j) formulate standard operating procedures for performance of its functions; and

(k) perform any other functions ancillary to the functions mentioned above.

5. Roles and Responsibilities of the employee.- (1) The employee shall:

(a) immediately upon becoming an employee, open a pension account with the Eligible Pension Fund Manager of his choice, in coordination with the Punjab Pension Fund;

(b) provide the relevant information regarding his pension account, including his selection between a conventional fund or a Shariah compliant fund, to the Accountant General through the concerned Drawing and Disbursing Officer on such forms as specified by the Accountant General for this purpose;

(c) make his contribution from his salary in accordance with the rules;

(d) be entitled to his pension account balance from the date of qualifying for the Defined Contribution Pension Scheme in accordance with the rules and subject to the conditions as specified in the Voluntary Pension System Rules, 2005;

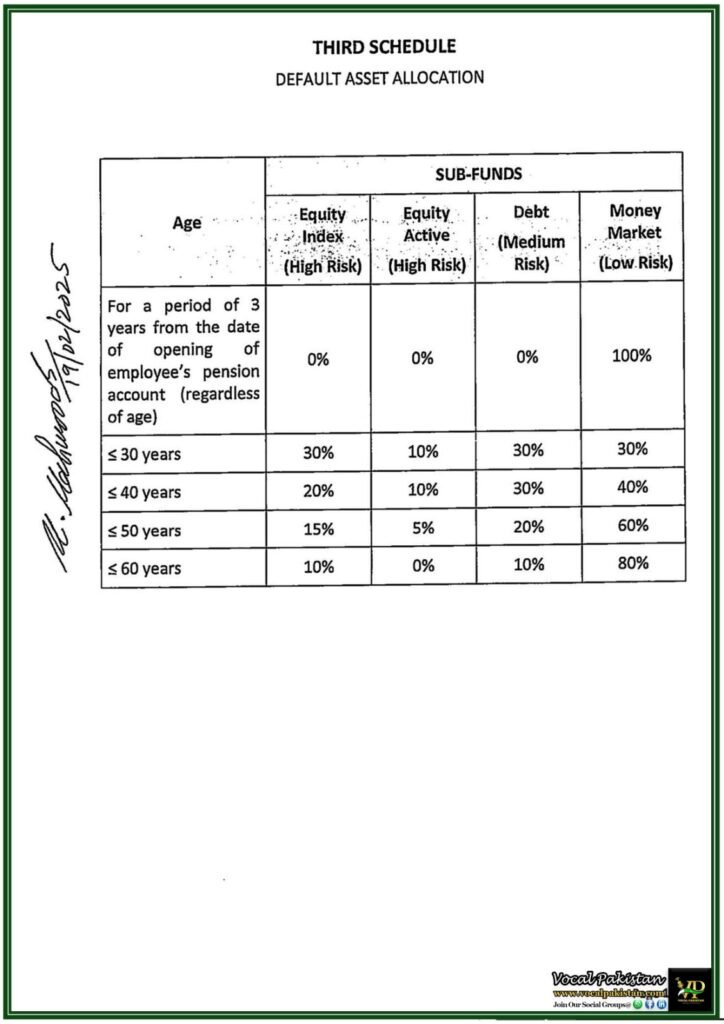

(e) determine the allocation policy for the contributions in his pension account among the sub-funds of the employer pension fund subject to the exposure limits as specified in the Second Schedule and shall communicate the allocation policy and any changes therein to the Eligible Pension Fund Manager through the Punjab Pension Fund:

Provided that an employee who does not indicate his allocation policy, his pension account shall be managed in accordance with the default allocation policy as specified in the Third Schedule;

(f) have the option to transfer his pension account with a particular Eligible Pension Fund Manager to another Eligible Pension Fund Manager as per the Voluntary Pension System Rules, 2005; and

(g) not withdraw any amount from his pension account before attaining the retirement age.

(2) Upon attaining the retirement age, the employee may withdraw in lump sum not more than twenty-five percent (25%) of the accumulated balance in his pension account and shall invest the remaining balance as per the Voluntary Pension System Rules, 2005 for a period of at least twenty years or till his death, whichever is earlier.

(3) Notwithstanding any other provision of the rules, upon leaving service before attaining the retirement age, the employee may, by informing the Punjab Pension Fund in writing, opt to no longer be subject to the rules and transfer his pension account from the employer pension fund to another employer pension fund or withdraw the accumulated balance in his pension account subject to the Voluntary Pension System Rules, 2005 and other applicable laws.

(4) In the event of pecuniary loss to the Provincial exchequer resulting from an employee’s action, omission or negligence, such employee shall be personally liable to make good such loss in the manner as provided under the Punjab Employees Efficiency, Discipline and Accountability Act 2006 (XII of 2006) and such liability shall extend to losses discovered after the employee’s retirement from service in accordance with the provisions of said Act.

SECRETARY

GOVERNMENT OF THE PUNJAB

FINANCE DEPARTMENT

Conclusion: Key Takeaways from Punjab’s Latest Pension Reform:

With the Punjab Defined Contribution Pension Scheme 2025, the government has taken a bold step towards a financially sustainable pension system. Key highlights include:

✅ Mandatory contributions from both employees and the government

✅ Investment-based pension system with conventional and Shariah-compliant fund options

✅ Online pension management portal for transparency and ease of access

✅ Defined governance structure involving the Finance Department, Punjab Pension Fund, and Pension Fund Managers

This reform ensures that employees’ retirement benefits are secure, systematically managed, and efficiently disbursed. The shift from a traditional pension system to a defined contribution model aligns Punjab’s pension system with global financial trends, ensuring long-term economic sustainability.

For more information, clarification or any other question feel free to join our WhatsApp Group. We are a supportive community where members are committed to assisting one another.