Revision Of Basic Pay Scales, Allowances And Pension Of Civil Employees Of Federal Government (2005)

Notification / OM No.

No.F.1(1)/Imp/2005

Dated:

1-July-2005

Notification Issued By:

(REGULATIONS WING) FINANCE DIVISION, GOVERNMENT OF PAKISTAN

GOVERNMENT OF PAKISTAN

FINANCE DIVISION

(REGULATIONS WING)

No.F.1(1)/Imp/2005

Islamabad, the 1st July, 2005

OFFICE MEMORANDUM

Subject: REVISION OF BASIC PAY SCALES, ALLOWANCES AND PENSION OF CIVIL EMPLOYEES OF FEDERAL GOVERNMENT (2005).

The President has been pleased to sanction the revision of Basic Pay Scales, Allowances and Pension w.e.f. 1st July, 2005, for the civil employees of the Federal Government, paid from the civil estimates and from the Defence estimates as detailed in the following paragraphs:-

PART.I – BASIC PAY SCALES

2. Revised Basic Pay Scales.

The revised Basic Pay Scales, 2005 shall replace the existing Basic Pay Scales, 2001 as shown in Annex to this O.M.

3. Fixation of Pay of the existing employees:

(i) The basic pay of an employee in service on 30.6.2005 shall be fixed in the Revised Basic Pay Scale on point to point basis i.e. at the stage corresponding to that occupied by him above the minimum of 2001 Basic Pay Scales.

(ii) The corresponding stage for fixation of basic pay in the aforesaid manner in respect of an employee whose pay was fixed beyond the maximum of the relevant scale as a result of discontinuation of move over policy under the 2001 Basic Pay Scales scheme shall be determined on notional extension basis i.e. by treating the amount of personal pay drawn by him on 30th June, 2005, as part of his basic pay scale and the amount beyond the maximum of the prescribed stage in the revised Basic Pay Scales shall be allowed as personal pay.

4. Annual Increment:

Annual increment shall continue to be admissible subject to the existing conditions, on 1st of December each year.

PART.II – ALLOWANCES

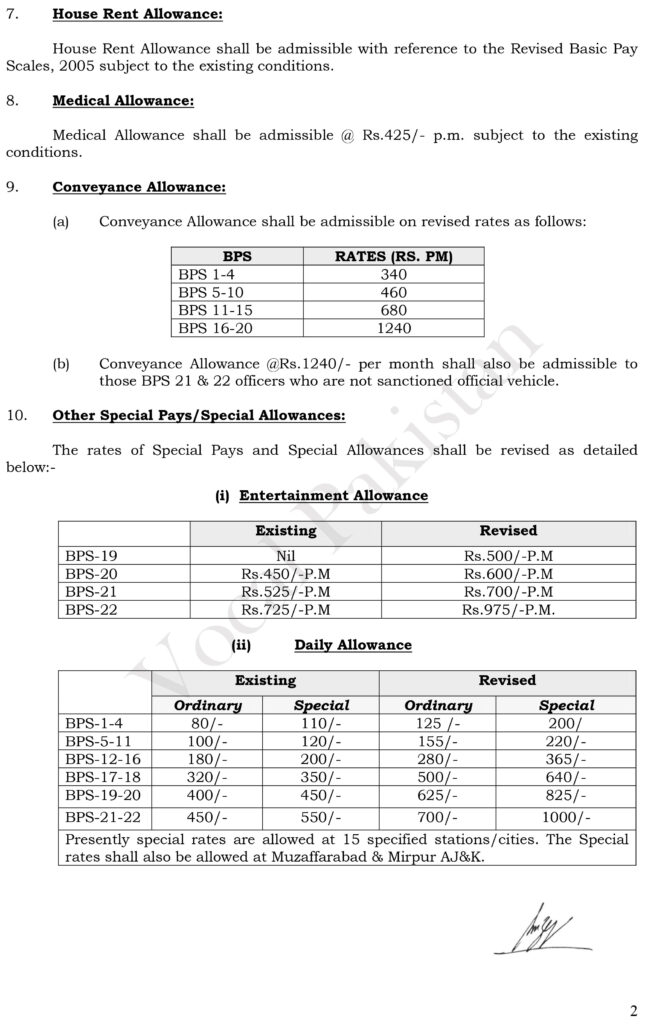

5. Special Additional Allowance: Special Additional Allowance shall continue to be admissible at frozen level on existing conditions.

6. Special Relief Allowance and Adhoc Relief: Special Relief Allowance and Adhoc Relief sanctioned w.e.f. 1.7.2003 and 1.7.2004 respectively shall stand frozen at the level of their admissibility as on 30.6.2005 and the amount shall continue to be admissible to the entitled recipients until further orders but it will cease to be admissible to new entrants joining Government service on or after 1.7.2005 as well as to those employees to whom it was ceased to be admissible under the existing conditions.

7. House Rent Allowance: House Rent Allowance shall be admissible with reference to the Revised Basic Pay Scales, 2005 subject to the existing conditions.

8. Medical Allowance: Medical Allowance shall be admissible @ Rs.425/- p.m. subject to the existing conditions.

9. Conveyance Allowance:

(a) Conveyance Allowance shall be admissible on revised rates as follows:

| BPS | RATES (RS. PM) |

| BPS 1-4 | 340 |

| BPS 5-10 | 460 |

| BPS 11-15 | 680 |

| BPS 16-20 | 1240 |

(b) Conveyance Allowance @Rs.1240/- per month shall also be admissible to those BPS 21 & 22 officers who are not sanctioned official vehicle.

10. Other Special Pays/Special Allowances:

The rates of Special Pays and Special Allowances shall be revised as detailed below:-

(i) Entertainment Allowance

| Existing | Revised | |

| BPS-19 | Nil | Rs.500/-P.M |

| BPS-20 | Rs.450/-P.M | Rs.600/-P.M |

| BPS-21 | Rs.525/-P.M | Rs.700/-P.M |

| BPS-22 | Rs.725/-P.M | Rs.975/-P.M. |

(ii) Daily Allowance

| Existing | Revised | |||

| Ordinary | Special | Ordinary | Special | |

| BPS-1-4 | 80/- | 110/- | 125 /- | 200/ |

| BPS-5-11 | 100/- | 120/- | 155/- | 220/- |

| BPS-12-16 | 180/- | 200/- | 280/- | 365/- |

| BPS-17-18 | 320/- | 350/- | 500/- | 640/- |

| BPS-19-20 | 400/- | 450/- | 625/- | 825/- |

| BPS-21-22 | 450/- | 550/- | 700/- | 1000/- |

| Presently special rates are allowed at 15 specified stations/cities. The Special rates shall also be allowed at Muzaffarabad & Mirpur AJ&K. | ||||

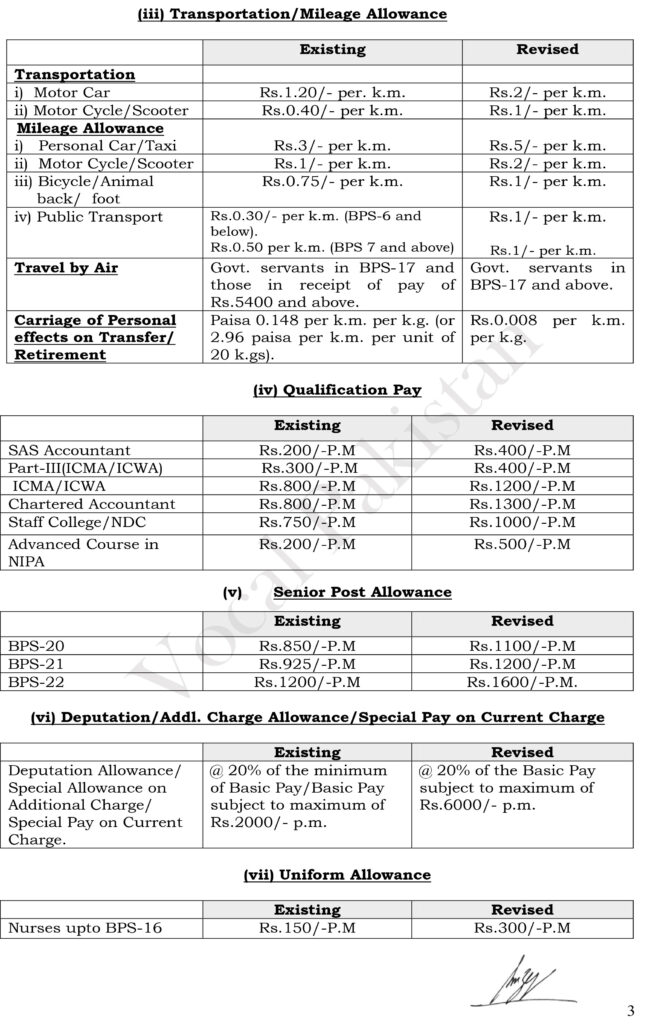

(iii) Transportation/Mileage Allowance

| Existing | Revised | |

| Transportation | ||

| i) Motor Car | Rs.1.20/- per. k.m. | Rs.2/- per k.m. |

| ii) Motor Cycle/Scooter | Rs.0.40/- per k.m. | Rs.1/- per k.m. |

| Mileage Allowance | ||

| i) Personal Car/Taxi | Rs.3/- per k.m. | Rs.5/- per k.m. |

| ii) Motor Cycle/Scooter | Rs.1/- per k.m. | Rs.2/- per k.m. |

| iii) Bicycle/Animal back/ foot | Rs.0.75/- per k.m. | Rs.1/- per k.m. |

| iv) Public Transport | Rs.0.30/- per k.m. (BPS-6 and below). Rs.0.50 per k.m. (BPS 7 and above) | Rs.1/- per k.m. Rs.1/- per k.m. |

| Travel by Air | Govt. servants in BPS-17 and those in receipt of pay of Rs.5400 and above. | Govt. servants in BPS-17 and above. |

| Carriage of Personal effects on Transfer/ Retirement | Paisa 0.148 per k.m. per k.g. (or 2.96 paisa per k.m. per unit of 20 k.gs). | Rs.0.008 per k.m. per k.g. |

(iv) Qualification Pay

| Existing | Revised | |

| SAS Accountant | Rs.200/-P.M | Rs.400/-P.M |

| Part-III(ICMA/ICWA) | Rs.300/-P.M | Rs.400/-P.M |

| ICMA/ICWA | Rs.800/-P.M | Rs.1200/-P.M |

| Chartered Accountant | Rs.800/-P.M | Rs.1300/-P.M |

| Staff College/NDC | Rs.750/-P.M | Rs.1000/-P.M |

| Advanced Course in NIPA | Rs.200/-P.M | Rs.500/-P.M |

(v) Senior Post Allowance

| Existing | Revised | |

| BPS-20 | Rs.850/-P.M | Rs.1100/-P.M |

| BPS-21 | Rs.925/-P.M | Rs.1200/-P.M |

| BPS-22 | Rs.1200/-P.M | Rs.1600/-P.M. |

(vi) Deputation/Addl. Charge Allowance/Special Pay on Current Charge

| Existing | Revised | |

| Deputation Allowance/ Special Allowance on Additional Charge/ Special Pay on Current Charge. | @ 20% of the minimum of Basic Pay/Basic Pay subject to maximum of Rs.2000/- p.m. | @ 20% of the Basic Pay subject to maximum of Rs.6000/- p.m. |

(vii) Uniform Allowance

| Existing | Revised | |

| Nurses upto BPS-16 | Rs.150/-P.M | Rs.300/-P.M |

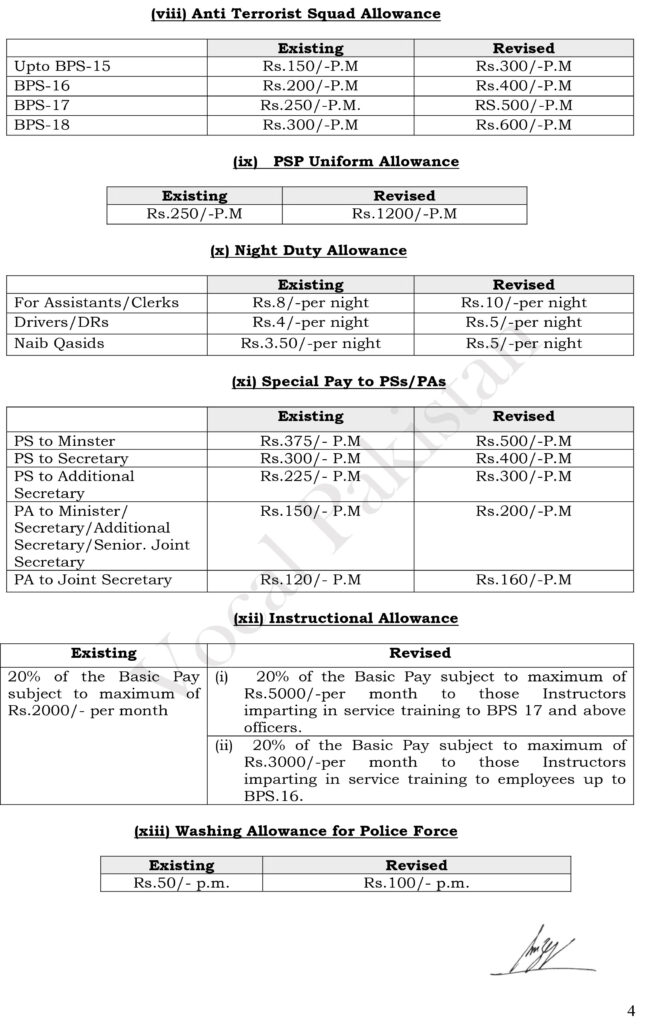

(viii) Anti Terrorist Squad Allowance

| Existing | Revised | |

| Upto BPS-15 | Rs.150/-P.M | Rs.300/-P.M |

| BPS-16 | Rs.200/-P.M | Rs.400/-P.M |

| BPS-17 | Rs.250/-P.M. | RS.500/-P.M |

| BPS-18 | Rs.300/-P.M | Rs.600/-P.M |

(ix) PSP Uniform Allowance

| Existing | Revised |

| Rs.250/-P.M | Rs.1200/-P.M |

(x) Night Duty Allowance

| Existing | Revised | |

| For Assistants/Clerks | Rs.8/-per night | Rs.10/-per night |

| Drivers/DRs | Rs.4/-per night | Rs.5/-per night |

| Naib Qasids | Rs.3.50/-per night | Rs.5/-per night |

(xi) Special Pay to PSs/PAs

| Existing | Revised | |

| PS to Minster | Rs.375/- P.M | Rs.500/-P.M |

| PS to Secretary | Rs.300/- P.M | Rs.400/-P.M |

| PS to Additional Secretary | Rs.225/- P.M | Rs.300/-P.M |

| PA to Minister/ Secretary/Additional Secretary/Senior. Joint Secretary | Rs.150/- P.M | Rs.200/-P.M |

| PA to Joint Secretary | Rs.120/- P.M | Rs.160/-P.M |

(xii) Instructional Allowance

| Existing | Revised |

| 20% of the Basic Pay subject to maximum of Rs.2000/- per month | (i) 20% of the Basic Pay subject to maximum of Rs.5000/-per month to those Instructors imparting in service training to BPS 17 and above officers. |

| (ii) 20% of the Basic Pay subject to maximum of Rs.3000/-per month to those Instructors imparting in service training to employees up to BPS.16. |

(xiii) Washing Allowance for Police Force

| Existing | Revised |

| Rs.50/- p.m. | Rs.100/- p.m. |

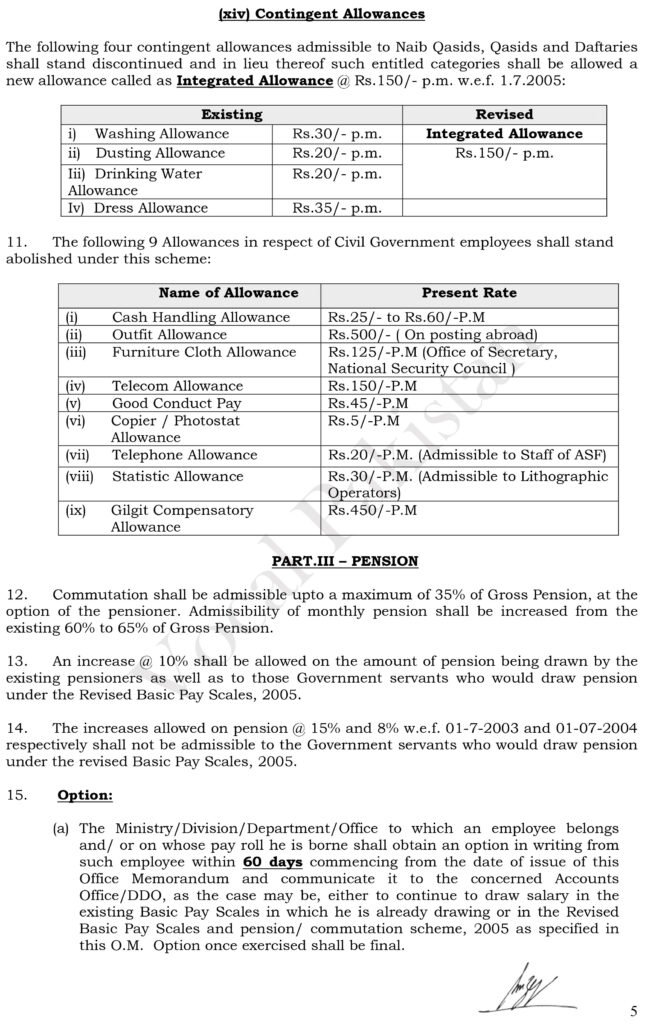

(xiv) Contingent Allowances

The following four contingent allowances admissible to Naib Qasids, Qasids and Daftaries shall stand discontinued and in lieu thereof such entitled categories shall be allowed a new allowance called as Integrated Allowance @ Rs.150/- p.m. w.e.f. 1.7.2005:

| Existing | Revised | |

| i) Washing Allowance | Rs.30/p.m | Integrated Allowance |

| ii) Dusting Allowance | Rs.20/- p.m. | Rs.150/- p.m. |

| iii) Drinking Water Allowance | Rs.20/- p.m. | |

| iv) Dress Allowance | Rs.35/- p.m. | |

11. The following 9 Allowances in respect of Civil Government employees shall stand abolished under this scheme:

| Name of Allowance | Present Rate |

| (i) Cash Handling Allowance | Rs.25/- to Rs.60/-P.M |

| (ii) Outfit Allowance | Rs.500/- ( On posting abroad) |

| (iii) Furniture Cloth Allowance | Rs.125/-P.M (Office of Secretary, National Security Council ) |

| (iv) Telecom Allowance | Rs.150/-P.M |

| (v) Good Conduct Pay | Rs.45/-P.M |

| (vi) Copier / Photostat Allowance | Rs.5/-P.M |

| (vii) Telephone Allowance | Rs.20/-P.M. (Admissible to Staff of ASF) |

| (viii) Statistic Allowance | Rs.30/-P.M. (Admissible to Lithographic Operators) |

| (ix) Gilgit Compensatory Allowance | Rs.450/-P.M |

PART.III – PENSION

12. Commutation shall be admissible upto a maximum of 35% of Gross Pension, at the option of the pensioner. Admissibility of monthly pension shall be increased from the existing 60% to 65% of Gross Pension.

13. An increase @ 10% shall be allowed on the amount of pension being drawn by the existing pensioners as well as to those Government servants who would draw pension under the Revised Basic Pay Scales, 2005.

14. The increases allowed on pension @ 15% and 8% w.e.f. 01-7-2003 and 01-07-2004 respectively shall not be admissible to the Government servants who would draw pension under the revised Basic Pay Scales, 2005.

15. Option:

(a) The Ministry/Division/Department/Office to which an employee belongs and/ or on whose pay roll he is borne shall obtain an option in writing from such employee within 60 days commencing from the date of issue of this Office Memorandum and communicate it to the concerned Accounts Office/DDO, as the case may be, either to continue to draw salary in the existing Basic Pay Scales in which he is already drawing or in the Revised Basic Pay Scales and pension/ commutation scheme, 2005 as specified in this O.M. Option once exercised shall be final.

(b) An existing employee as aforesaid, who does not exercise and communicate such an option within the specified time limit, shall be deemed to have opted to continue to draw salary in the Basic Pay Scales and Pension/ Commutation Scheme applicable to him as on 30-06-2005.

16. All existing rules/orders on the subject shall be deemed to have been modified to the extent indicated above. All existing rules/orders not so modified shall continue to be in force under this scheme.

17. Anomalies: An Anomaly Committee shall be set up in the Finance Division (Regulations Wing) to resolve the anomalies if any, arising in the implementation of this Office Memorandum.

Sr. Joint Secretary (Regs.)

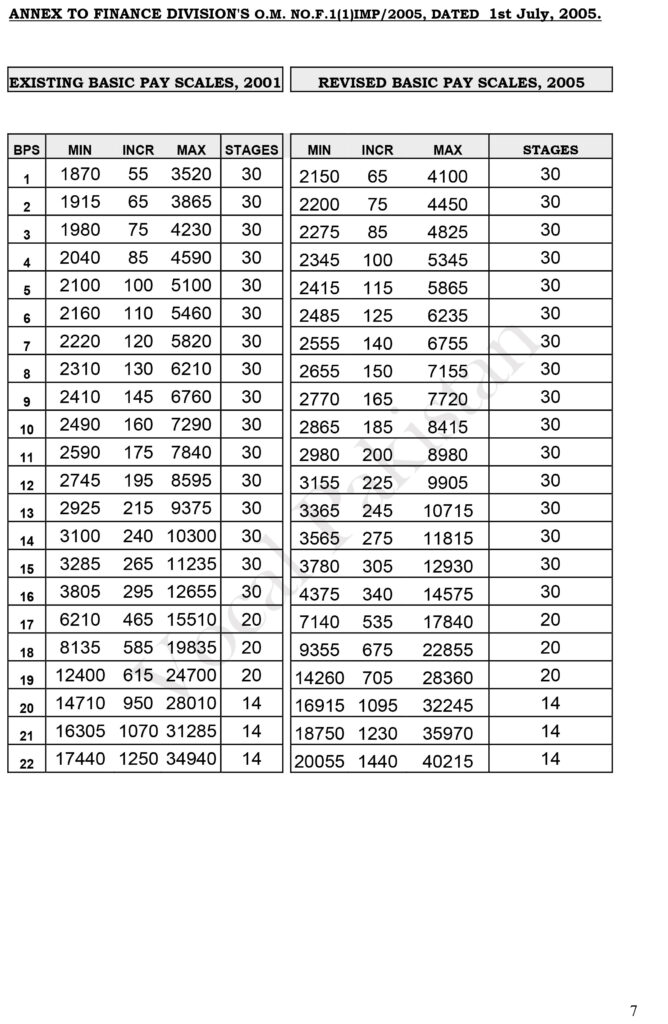

ANNEX TO FINANCE DIVISION’S O.M. NO.F.1(1)IMP/2005, DATED 1st July, 2005.

| EXISTING BASIC PAY SCALES, 2001 | REVISED BASIC PAY SCALES, 2005 | ||||||||

| BPS | MIN | INCR | MAX | STAGES | MIN | INCR | MAX | STAGES | |

| 1 | 1870 | 55 | 3520 | 30 | 2150 | 65 | 4100 | 30 | |

| 2 | 1915 | 65 | 3865 | 30 | 2200 | 75 | 4450 | 30 | |

| 3 | 1980 | 75 | 4230 | 30 | 2275 | 85 | 4825 | 30 | |

| 4 | 2040 | 85 | 4590 | 30 | 2375 | 100 | 5345 | 30 | |

| 5 | 2100 | 100 | 5100 | 30 | 2415 | 115 | 5865 | 30 | |

| 6 | 2160 | 110 | 5460 | 30 | 2485 | 125 | 6235 | 30 | |

| 7 | 2220 | 120 | 5820 | 30 | 2555 | 140 | 6755 | 30 | |

| 8 | 2310 | 130 | 6210 | 30 | 2655 | 150 | 7155 | 30 | |

| 9 | 2410 | 145 | 6760 | 30 | 2770 | 165 | 7720 | 30 | |

| 10 | 2490 | 160 | 7290 | 30 | 2865 | 185 | 8415 | 30 | |

| 11 | 2590 | 175 | 7840 | 30 | 2980 | 200 | 8980 | 30 | |

| 12 | 2745 | 195 | 8595 | 30 | 3155 | 225 | 9905 | 30 | |

| 13 | 2925 | 215 | 9375 | 30 | 3365 | 245 | 10715 | 30 | |

| 14 | 3100 | 240 | 10300 | 30 | 3565 | 275 | 11815 | 30 | |

| 15 | 3285 | 265 | 11235 | 30 | 3780 | 305 | 12930 | 30 | |

| 16 | 3805 | 295 | 12655 | 30 | 4375 | 340 | 14575 | 30 | |

| 17 | 6210 | 465 | 15510 | 20 | 7140 | 535 | 17840 | 20 | |

| 18 | 8135 | 585 | 19835 | 20 | 9355 | 675 | 22855 | 20 | |

| 19 | 12400 | 615 | 24700 | 20 | 14260 | 705 | 28360 | 20 | |

| 20 | 14710 | 950 | 28010 | 14 | 16915 | 1095 | 32245 | 14 | |

| 21 | 16305 | 1070 | 31285 | 14 | 18750 | 1330 | 35970 | 14 | |

| 22 | 17440 | 1250 | 34940 | 14 | 20055 | 1440 | 40215 | 14 | |